Ayushman Bharat Yojana (PMJAY): Introduction

Ayushman Bharat Yojana, also known as the Pradhan Mantri Jan Arogya Yojana (PMJAY), is a programme designed to assist economically disadvantaged members of society who require access to healthcare.

This health insurance scheme, rolled out by the Prime Minister on September 23, 2018, covers approximately 50 billion citizens in India and already has several success tales to its credit. As of September 2019, approximately 18,059 hospitals were associated with the scheme, over 4,406,461 beneficiaries had been admitted, and over ten billion e-cards had been distributed.

Pradhan Mantri Jan Arogya Yojana is the new moniker for the Ayushman Bharat Yojana – National Health Protection Scheme. This proposal intends to make secondary and tertiary healthcare for the underprivileged completely cashless. Beneficiaries of the PM Jan Arogya Yojana receive an e-card that can be used at any public or private facility in the country that participates in the programme. With it, you can stroll into a hospital and receive treatment without paying cash.

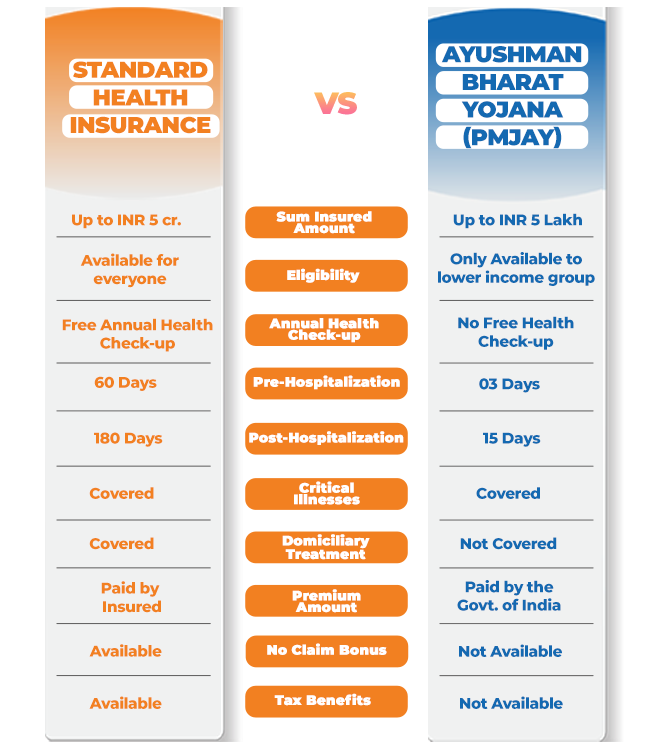

Three days of pre-hospitalization and fifteen days of post-hospitalization expenses are covered. In addition, approximately 1,400 procedures and all associated costs, such as OT expenses, are covered. PMJAY provides coverage of Rs. 5 lakh per family per year, thereby facilitating access to healthcare services for the economically disadvantaged.

- Ayushman Bharat Yojana (PMJAY): Introduction

- PMJAY health cover categories: eligibility criteria for rural and urban people

- The Ayushman Bharat Scheme (PMJAY) medical packages and hospitalisation process.

- PMJAY illness coverage: Here is a list of the serious diseases that are covered by PM Jan Arogya Yojana

- Health insurance benefits in India

- How to apply for the Ayushman Bharat Yojana (application process): Ayushman Bharat registration.

- Ayushman Bharat Yojana: PMJAY patient card generation

PMJAY health cover categories: eligibility criteria for rural and urban people

Through a health insurance scheme covering Rs. 5 lakh per family, the PMJAY seeks to provide healthcare to 10 crore families, the majority of which are poor or have a lower middle income. The ten billion households include eight billion in rural areas and 2.33 billion in urban areas. This implies that 50 billion individual beneficiaries will be targeted by the programme, which will be subdivided into smaller entities.

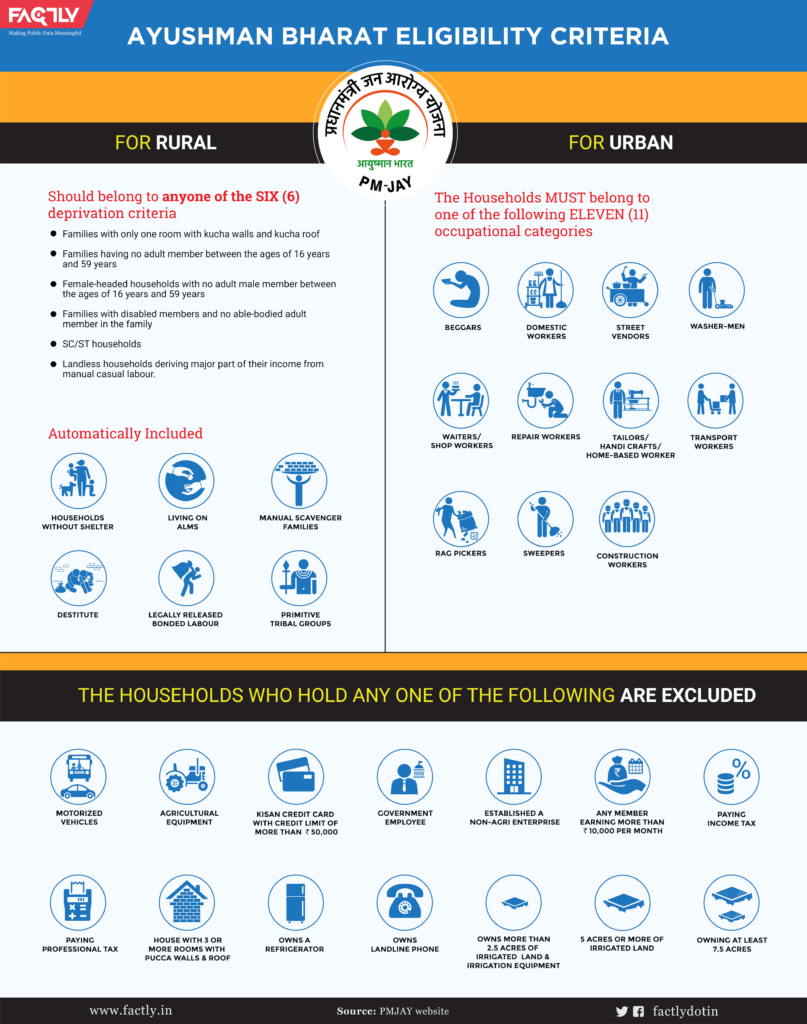

However, the programme has prerequisites that determine who is eligible for the health coverage benefit. In rural areas, the list of PMJAY beneficiaries is primarily categorised by lack of accommodation, meagre income, and other deprivations; in urban areas, the list is compiled based on occupation.

PMJAY rural

National Sample Survey Organisation’s 71st round reveals that an astounding 85.9% of rural households lack access to health insurance or assurance. Additionally, 24% of rural families borrow money to access healthcare facilities. PMJAY seeks to aid this sector in avoiding debt traps and accessing services by providing up to Rs. 5 lakh per family annually. According to the 2011 Socio-Economic Caste Census, the programme will aid economically disadvantaged families. Similarly, communities enrolled in the Rashtriya Swasthya Bima Yojana (RSBY) will fall within the PM Jan Arogya Yojana’s purview.

Who is eligible for PMJAY health coverage in rural areas?

- Those residing in Scheduled Caste and Scheduled Tribe

- Families without a male between the ages of 16 and 59

- Beggars and those who survive on charity

- Families without any members aged between 16 and 59

- Families in which at least one member is physically challenged and no adult is able-bodied

- Households without land who earn a living as casual manual labourers

- Primitive tribal communities

- Legally released bonded labourers

- Families living in one-room shacks lacking appropriate walls and roofs

- Families that scavenge manually

Read More: Top 10 Benefits of Ayushman Bharat Yojana (PMJAY)

PMJAY urban

According to the 71st round of the National Sample Survey Organisation, 82% of urban households lack health insurance. In addition, 18% of urban Indians have borrowed money to pay for healthcare costs in one form or another. Pradhan Mantri The Jan Arogya Yojana helps these households obtain healthcare by supplying up to Rs. 5 lakh per family per year in funding. PMJAY will benefit the families of urban employees in the 2011 Socio-Economic Caste Census occupational category. In addition, any family enrolled in the Rashtriya Swasthya Bima Yojana is eligible to receive benefits from the PM Jan Arogya Yojana.

The majority of metropolitan residents eligible for the government-sponsored programme are:

- The washermen and chowkidars

- Ragpickers

- Technicians, electricians, and repairmen

- Domestic aid

- Sanitation employees, gardeners, sweepers

- Craftspeople or artisans working from home, tailors

- Cobblers, peddlers and other services offered on streets or pavements

- Carpenters, masons, construction labourers, porters, welders, painters, and security officers are in demand.

- Transport employees such as drivers, conductors, assistants, and waggon or rickshaw pullers

- Assistents, peons in modest establishments, delivery boys, shopkeepers, and waiters are examples of the following occupations

Individuals not eligible for health coverage under the Pradhan Mantri Jan Arogya Yojana:

- Those who own a two-, three-, or four-wheeled vehicle or an engine-powered fishing craft

- Those who own agricultural machinery.

- Those who have Rs. 50,000 credit limits on their Kisan cards

- Those working for the government

- Those employed by government-run non-agricultural businesses

- Those with a monthly income in excess of Rs. 10,000

- Owners of refrigerators and landlines

- Those with adequate, sturdy dwellings

- Those who own at least 5 acres of agricultural land

The Ayushman Bharat Scheme (PMJAY) medical packages and hospitalisation process.

The 5 lakh rupee insurance coverage provided by the Pradhan Mantri Jan Arogya Scheme is beneficial to both individuals and families. This single sum is sufficient to cover medical and surgical procedures in 25 specialties, including cardiology, neurosurgery, oncology, paediatrics, and orthopaedics. However, surgical and medical expenses cannot be reimbursed concurrently.

If multiple surgeries are required, the greatest package cost is covered first, followed by a 50% discount on the second and a 25% discount on the third. In contrast to other health insurance programmes, there is no waiting period for pre-existing conditions under the PMJAY programme, which is part of the larger Ayushman Bharat Yojana programme. If a beneficiary or a member of their family requires hospitalisation and is admitted to a participating government or private facility, there is no cost.

The cashless hospitalisation and treatment are made possible by a 60:40 cost-sharing agreement between the federal government and the states. Ayushman Mitras with specialised training will issue a health certificate to you or a member of your family once your eligibility has been confirmed. They administer kiosks in hospitals for individuals unfamiliar with the PMJAY programme.

With this information, you can take advantage of the Pradhan Mantri Jan Awas Yojana or assist someone else in obtaining the healthcare coverage benefit.

Read More: Top 10 Benefits of Ayushman Bharat Yojana (PMJAY)

PMJAY illness coverage: Here is a list of the serious diseases that are covered by PM Jan Arogya Yojana

PMJAY aids families gain access to secondary and tertiary care by providing up to 5 lakh rupees per family, per year. This assistance is applicable to both nursery procedures and pre-existing conditions. PMJAY provides coverage for over 1,350 medical services at public and private institutions with participating providers.

Among the critical illnesses covered are the following:

- Prostate cancer

- Coronary artery bypass grafting

- Double valve replacement

- Carotid angioplasty with stent

- Pulmonary valve replacement

- Skull base surgery

- Laryngopharyngectomy with gastric pull-up

- Anterior spine fixation

- Tissue expander for disfigurement following burns

Here are some of the PMJAY exclusions:

- OPD

- Drug rehabilitation programme

- Cosmetic related procedures

- Fertility related procedures

- Organ transplants

- Individual diagnostics (for evaluation)

Health insurance benefits in India

The biggest benefit of having health insurance is that you may receive medical care without having to worry about your finances getting in the way. Additionally, using PMJAY’s features reduces the chance of falling into a debt trap because many Indians end up borrowing money on the black market to pay for medical expenses. Under PMJAY, you are eligible for treatment up to Rs. 5 lakh. Additionally, you can purchase a health insurance policy from well-known insurance providers like Bajaj Finserv, which provides extra benefits and coverages for you and your family.

To protect your complete family under one roof, you can either get a family health insurance plan or opt for an individual health insurance plan. It is recommended for senior persons to get a different health insurance plan to cover their medical costs. There are numerous senior health insurance programmes that offer sufficient financial protection.

As an alternative, you might look at low-cost health insurance plans like Pocket Insurance from Bajaj Finserv, which provides economical plans tailored to certain needs. Additionally, you may quickly apply for these plans online. For example, Dengue Cover offers daily financial support of up to Rs. 1,000 per day that you can utilise for a variety of needs, while Hospital financial Cover assists you in paying for diagnostic testing should you catch malaria or dengue. If you have kidney stones, you can also acquire plans like Kidney Stones Cover or Adventure Cover in case you get hurt. No matter whatever policy you select, you may get comprehensive coverage for a low price and immediately safeguard every element of your health.

How to apply for the Ayushman Bharat Yojana (application process): Ayushman Bharat registration.

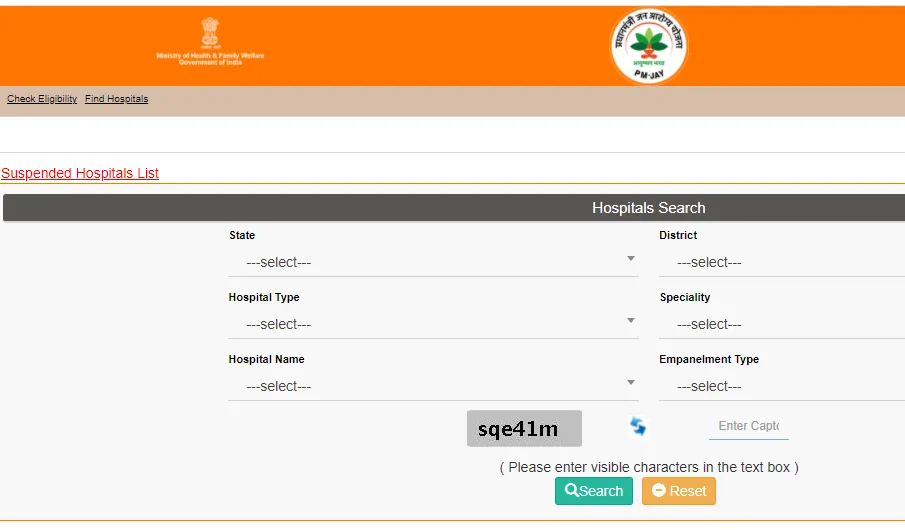

There is no PMJAY-specific Ayushman Bharat registration process. PMJAY is applicable to all beneficiaries identified by the SECC 2011 and those who are already RSBY participants. However, here is how you can determine if you are eligible to receive PMJAY.

- Visit the PMJAY website and select “Am I Eligible?”

- Enter your mobile phone number and the CAPTCHA code, then click on the ‘Generate OTP’ button.

- Then select your state and conduct a search by name, HHD number, ration card number, or mobile number.

- You can use the search results to determine whether your family is covered by PMJAY.

Alternately, you can contact any Empanelled Health Care Provider (EHCP) or call the Ayushman Bharat Yojana call centre at 14555 or 1800-111-565 to determine your eligibility for PMJAY.

Ayushman Bharat Yojana: PMJAY patient card generation

After becoming eligible for PMJAY benefits, you can work towards obtaining an e-card. Before issuing a card, your Aadhaar card or ration card will be verified at the PMJAY kiosk. Family identification documents include a government-certified inventory of family members, a PM letter, and an RSBY card. Once the verification is complete, both the e-card and the unique AB-PMJAY ID are printed. This can be used as evidence at any stage in the future.

There may be inadvertent inaccuracies, typographical errors, or delays in updating the information, products, and services included or accessible on our website and related platforms/websites. The information contained on this site and associated web pages is provided for reference and general information purposes only, and in the event of any inconsistency, the specifics specified in the respective product/service document shall take precedence. Before acting on the basis of the information contained herein, subscribers and users should seek professional advice. Please make an informed decision regarding any product or service after reviewing the applicable product or service documentation and terms and conditions. If any inconsistencies are observed, kindly click here to contact us.

*Terms and conditions apply