In this digital era, financial services are constantly evolving to meet the ever-growing needs of consumers and businesses alike. One such innovation that has gained significant attention in recent years is the Open Credit Enablement Network (OCEN). OCEN is revolutionizing the way credit is accessed and shared, creating new opportunities for financial inclusion and seamless lending processes. In this article, we’ll delve into the world of Open Credit Enablement Network (OCEN), exploring its core concepts, benefits, challenges, and its potential impact on the financial landscape.

What is the Open Credit Enablement Network (OCEN)?

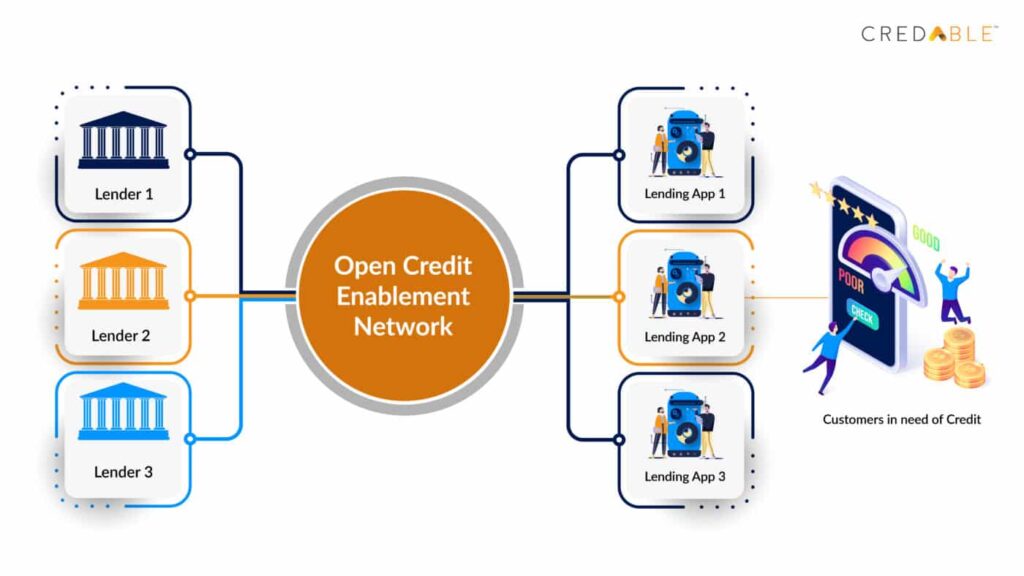

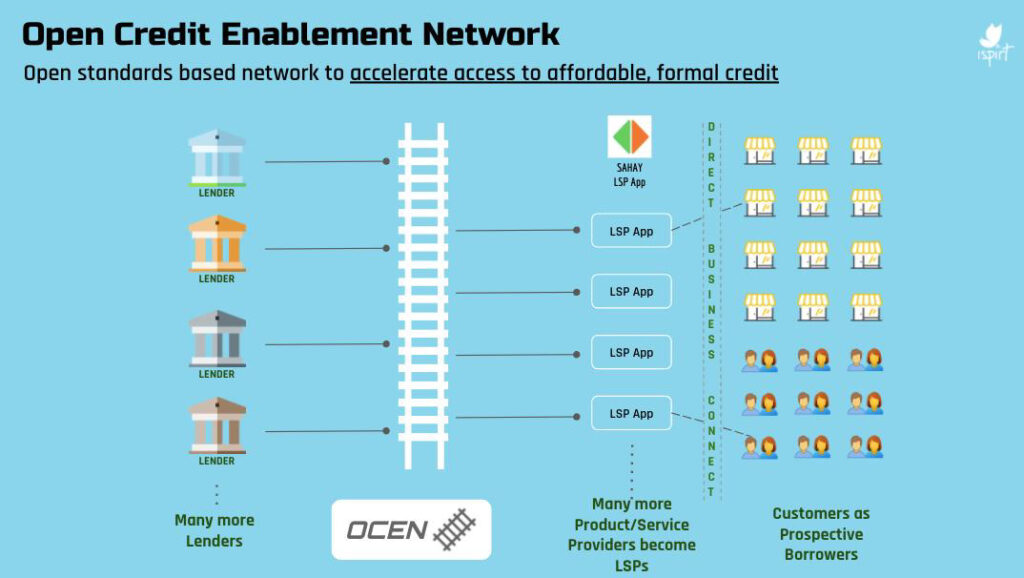

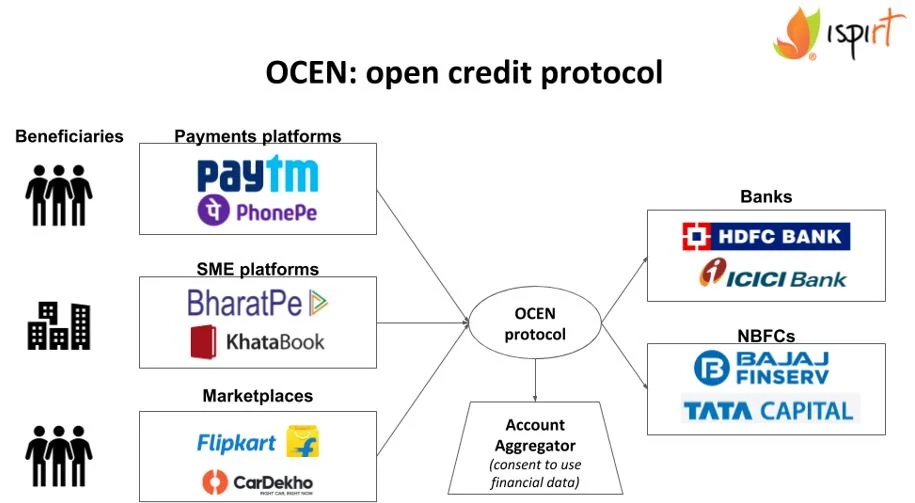

At its essence, the Open Credit Enablement Network (OCEN) is an open, standardized infrastructure that enables secure and transparent credit sharing between financial institutions, fintech companies, and other relevant stakeholders. It operates through a system of Application Programming Interfaces (APIs) that allow these entities to interact, exchange credit information, and facilitate lending in real-time.

The Advantages of OCEN

OCEN brings forth a myriad of advantages for both lenders and borrowers. For lenders, it offers a more comprehensive view of an applicant’s creditworthiness by accessing data from various sources, including alternative data that traditional credit bureaus might not consider. This results in more accurate risk assessments and better lending decisions. On the other hand, borrowers benefit from a smoother and faster loan approval process, especially for those with limited credit history.

How Does OCEN Work?

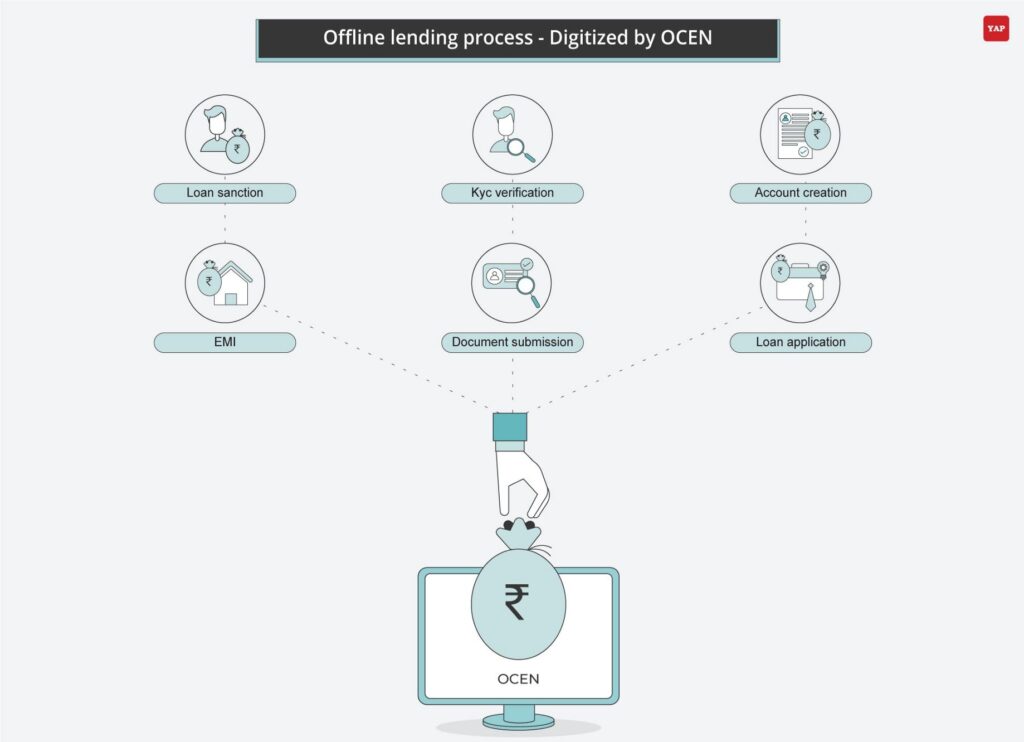

OCEN operates on the principles of collaboration and data-sharing. Financial institutions, fintech companies, and credit bureaus participate in the network and provide access to their credit data through secure APIs. These APIs enable real-time data exchange, ensuring that the credit information is always up-to-date. When a borrower applies for credit, the lender can access the borrower’s credit data from the OCEN network, evaluate the credit risk, and make an informed lending decision.

Additional Read: How to Leverage the Open Credit Network for Sustainable Growth and Community Collaboration

OCEN and Financial Inclusion

One of the most promising aspects of OCEN is its potential to enhance financial inclusion. Traditional credit evaluation methods often exclude segments of the population with limited credit histories, making it challenging for them to access credit. OCEN’s ability to incorporate alternative data helps bridge this gap, enabling more individuals and small businesses to access credit and participate in the formal financial system.

OCEN’s Impact on Digital Lending

Digital lending platforms have been gaining popularity due to their convenience and accessibility. OCEN complements these platforms by providing standardized credit data, reducing the need for redundant data collection, and streamlining the lending process. This interoperability fosters innovation in the digital lending space, leading to the development of new and competitive financial products.

The Role of APIs in OCEN

APIs play a crucial role in OCEN, serving as the medium through which different financial institutions and entities communicate and share credit information. These APIs adhere to specific protocols and standards, ensuring a secure and seamless exchange of data. Standardization fosters a collaborative ecosystem, where entities can focus on their core competencies while relying on the shared infrastructure of OCEN.

OCEN Security and Data Privacy

With any system that involves sensitive financial data, security and data privacy are of paramount importance. OCEN prioritizes robust security measures and compliance with data protection regulations. Encryption and authentication mechanisms safeguard the data exchanged through the network, giving users the confidence that their information remains confidential.

Additional Read: Comparing Credit Enablement Platforms: Finding the Best Financing Solutions for Your Needs

Challenges and Limitations of OCEN

Despite its potential, OCEN also faces certain challenges. One of the primary concerns is the proper vetting and verification of alternative data sources to ensure their reliability. Additionally, the integration of diverse systems from various entities requires meticulous planning and implementation. Addressing these challenges is crucial to realizing the full potential of OCEN.

Future Prospects of OCEN

The future of OCEN looks promising, given its ability to foster financial inclusion and revolutionize the credit-sharing landscape. As more financial institutions and fintech companies adopt OCEN, the network’s value and effectiveness will continue to grow. Furthermore, ongoing advancements in technology and data analytics will likely enhance the accuracy and efficiency of credit assessments, further boosting OCEN’s appeal.

Conclusion

The Open Credit Enablement Network (OCEN) represents a transformative force in the world of finance and lending. By creating an open and collaborative platform for credit sharing, OCEN paves the way for increased financial inclusion, smoother lending processes, and innovative digital lending solutions. As the network continues to gain traction, it has the potential to reshape the financial industry and improve access to credit for individuals and businesses alike.

FAQs

- Is OCEN limited to a specific region or country? OCEN is designed as an open and global infrastructure, allowing participation from financial institutions and entities worldwide.

- Can alternative data really provide an accurate credit assessment? Yes, alternative data, when properly vetted, can offer valuable insights into an applicant’s creditworthiness, especially for those with limited credit history.

- Is OCEN regulated by any governing body? OCEN adheres to relevant financial regulations and data protection laws to ensure the security and privacy of credit data.

- Can individuals access their credit information through OCEN? OCEN primarily serves as a platform for financial institutions and lenders to exchange credit data. However, individuals may indirectly benefit from improved access to credit through OCEN-enabled processes.

- How does OCEN ensure data accuracy and prevent fraud? OCEN employs robust security measures, data encryption, and authentication protocols to safeguard the integrity of data shared within the network, reducing the risk of fraud.