Introduction

In the fast-paced world of finance, there are various investment avenues available to individuals looking to grow their wealth and manage risk effectively. Two popular financial instruments that have gained significant attention from investors are futures and options. In this article, we will delve into the depths of futures and options, exploring what they are, how they work, and the benefits they offer to investors.

- Introduction

- Understanding Futures and Options

- Unraveling Options

- Key Differences Between Futures and Options

- Strategies for Trading Futures and Options

- Risks Associated with Futures and Options Trading

- How to Get Started with Futures and Options Trading

- The Role of Futures and Options in Risk Management

- Tax Implications of Futures and Options Trading

- Advancements in Technology and Futures/Options Trading

- Regulations and Oversight in Futures and Options Markets

- Key Tips for Successful Futures and Options Trading

- Common Misconceptions about Futures and Options

- Conclusion

- FAQs

Understanding Futures and Options

What are Futures and Options?

Futures and options are derivative contracts that derive their value from underlying assets like stocks, commodities, or indices. They offer investors the opportunity to buy or sell the asset at a predetermined price and time in the future. These financial instruments are traded on exchanges, providing liquidity and transparency to the market.

Unraveling Options

Call and Put Options

Options come in two forms: call options and put options. A call option gives the holder the right, but not the obligation, to buy the underlying asset at a specified price (strike price) before the expiration date. On the other hand, a put option grants the holder the right, but not the obligation, to sell the underlying asset at the strike price on or before the expiry date.

Option Premiums and Strike Prices

To acquire an option, the investor pays a premium to the option seller. This premium is the price of the option and is influenced by factors such as the underlying asset’s price, volatility, time to expiration, and interest rates. The strike price determines the price at which the asset will be bought or sold if the option is exercised.

Key Differences Between Futures and Options

Contractual Obligations

In a futures contract, both parties are obligated to fulfill the terms of the contract on the expiration date. On the other hand, options provide the right, but not the obligation, to execute the contract.

Risk and Reward Profiles

Futures trading carries higher risks and rewards compared to options. The potential for both gains and losses is substantial in futures contracts, while the risk for options holders is limited to the premium paid.

Liquidity and Trading Volume

Futures markets typically have higher trading volumes and greater liquidity than options markets due to their standardized nature and widespread use in various industries.

Strategies for Trading Futures and Options

Hedging

Hedging involves using futures and options contracts to protect against potential losses in the underlying asset. It is a risk management technique widely used by corporations and investors to mitigate market uncertainties.

Speculation

Speculative trading involves making bets on the future price movements of assets. Traders use futures and options contracts to capitalize on price fluctuations and profit from their predictions.

Spreading

Spreading is a strategy where traders simultaneously take positions in multiple futures or options contracts to exploit price differentials and reduce risk.

Risks Associated with Futures and Options Trading

Market Risk

Futures and options markets are influenced by various external factors, such as geopolitical events, economic data releases, and shifts in market sentiment, which can lead to significant price fluctuations.

Counterparty Risk

There is a risk of the counterparty defaulting on the contract, leading to potential financial losses for the parties involved.

Time Decay

Options contracts lose value as they approach their expiration date, leading to a decrease in the option premium over time.

How to Get Started with Futures and Options Trading

Selecting a Broker

Choosing a reliable and reputable broker is crucial for successful futures and options trading. Look for brokers that offer competitive fees, educational resources, and a user-friendly platform.

Conducting Research and Analysis

Thorough research and analysis of the underlying asset and market trends are essential to make informed trading decisions.

Building a Trading Plan

Having a well-defined trading plan that outlines your risk tolerance, trading goals, and exit strategies is fundamental for disciplined trading.

The Role of Futures and Options in Risk Management

Hedging Against Price Fluctuations

Futures and options can help individuals and businesses protect themselves against adverse price movements, ensuring greater stability in cash flows and profits.

Portfolio Diversification

Incorporating futures and options in a diversified investment portfolio can lower overall risk and increase the potential for higher returns.

Minimizing Downside Risk

Futures and options allow investors to limit potential losses, providing a safety net during market downturns.

Tax Implications of Futures and Options Trading

Short-term vs. Long-term Capital Gains

Taxation on profits from futures and options trading depends on the holding period of the investment. Short-term gains are typically taxed at higher rates than long-term gains.

Tax Treatment for Different Instruments

Different financial instruments are subject to varying tax treatments, so it is essential to understand the tax implications of each trade.

Reporting Requirements

Traders must adhere to tax reporting regulations, accurately reporting their gains and losses from futures and options trading.

Advancements in Technology and Futures/Options Trading

Algorithmic Trading

Advancements in technology have paved the way for algorithmic trading, where computer programs execute trades based on predefined strategies and market conditions.

High-Frequency Trading

High-frequency trading (HFT) relies on powerful computers and algorithms to execute trades at incredibly high speeds, capitalizing on even the smallest market inefficiencies.

Impact on Market Efficiency

The widespread use of technology in futures and options trading has influenced market efficiency and liquidity, providing more opportunities for investors and reducing bid-ask spreads.

Regulations and Oversight in Futures and Options Markets

Commodity Futures Trading Commission (CFTC)

In the United States, the CFTC oversees the futures and options markets to ensure fair practices and prevent fraud or manipulation.

Securities and Exchange Board of India (SEBI)

In India, the SEBI is responsible for regulating and supervising the securities and commodities markets, protecting investors’ interests.

Ensuring Market Integrity and Investor Protection

Regulatory bodies play a crucial role in maintaining market integrity and safeguarding the interests of investors and participants.

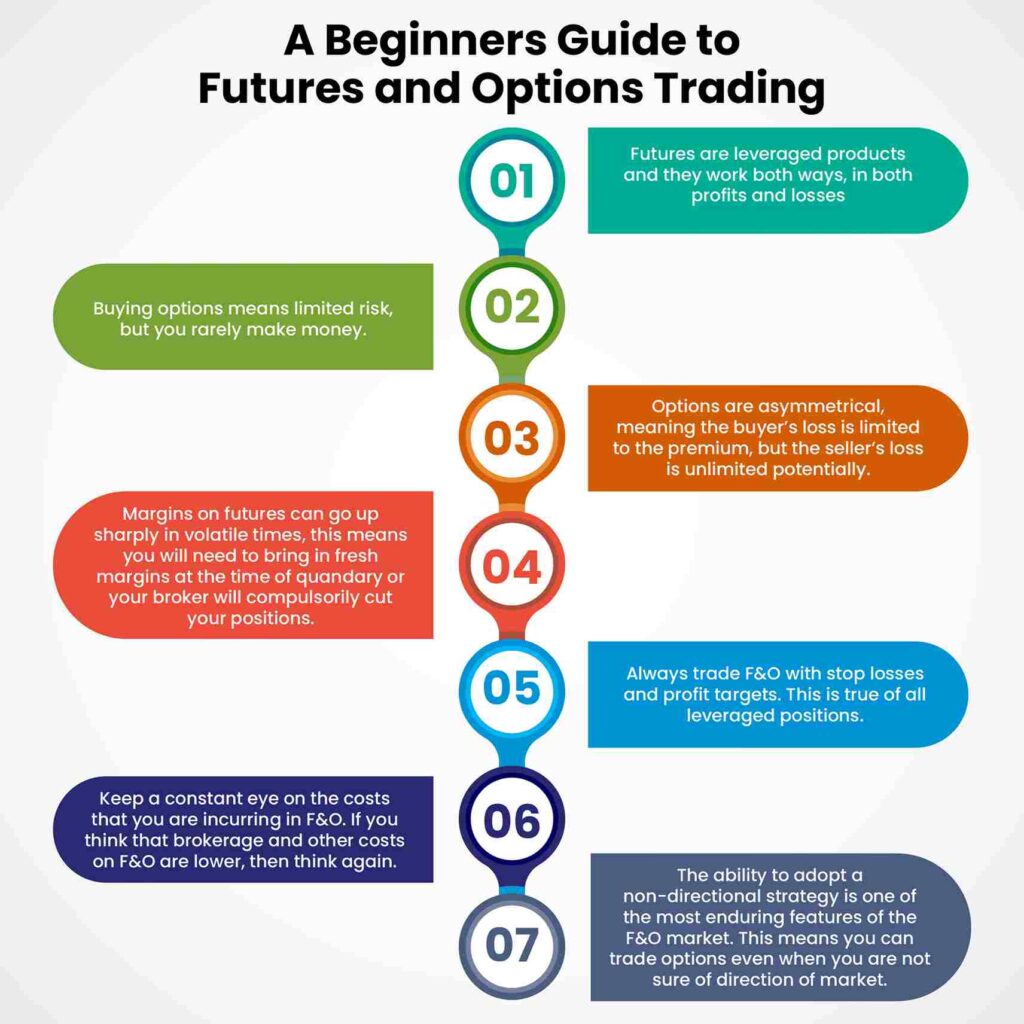

Key Tips for Successful Futures and Options Trading

Staying Informed about Market Developments

Being up-to-date with the latest market news and trends is essential for making well-informed trading decisions.

Controlling Emotions and Avoiding Impulsive Decisions

Discipline is crucial in futures and options trading. Avoid letting emotions dictate your trades and stick to your trading plan.

Practicing Risk Management

Managing risk effectively is vital for long-term success in futures and options trading. Only risk what you can afford to lose.

Common Misconceptions about Futures and Options

Speculative Nature vs. Gambling

While futures and options involve speculation, they are based on informed decisions and market analysis, not blind luck like gambling.

Only for Advanced Investors

Futures and options are accessible to all investors with different risk appetites, and they can play a role in diversified portfolios.

Need for Huge Capital

Contrary to popular belief, futures and options trading can be done with a relatively small amount of capital, thanks to leverage.

Conclusion

In conclusion, futures and options are powerful financial instruments that offer investors the opportunity to hedge, speculate, and diversify their portfolios. Understanding how these derivatives work and the risks involved is essential for making informed investment decisions. By incorporating futures and options in their financial strategies, investors can harness the potential of these instruments to achieve their financial goals.

FAQs

Q: Is options trading riskier than futures trading?

A: Options trading carries limited risk compared to futures trading, as losses are capped at the premium paid for the option.

Q: Can I trade futures and options without a broker?

A: No, futures and options trading requires a brokerage account, and a broker facilitates the buying and selling of contracts.

Q: Are futures and options suitable for beginners?

A: While futures and options can be complex, with proper research and understanding, beginners can gradually explore these instruments.

Q: Are futures and options only used for speculative purposes?

A: No, futures and options are also widely used for hedging against price fluctuations and managing risk.

Q: How can I learn more about futures and options trading?

A: There are numerous educational resources, books, and online courses available to expand your knowledge of futures and options trading.