Are you looking for TVS Personal Loan Interest Rate? TVS Credit can help you save money on your loan by offering competitive interest rates and flexible repayment terms.

- Benefits of choosing a TVS Personal Loan:

- TVS Personal Loan Interest Rate

- How to Lower Your TVS Personal Loan Interest Rate

- Comparison of Personal Loan Interest Rate offered by Various Lenders

- How to Save Interest on Your Personal Loan

- Eligibility Criteria for TVS Credit Personal Loan

- Documents Required for TVS credit Personal Loan

- How to Apply for TVS Credit Personal Loan

- FAQs

We understand that everyone’s financial situation is different, which is why we offer a variety of personal loan options to fit your needs. Whether you’re looking for a loan to consolidate debt, finance a major purchase, or simply make a large expense, we can help you find the right loan for you.

Our personal loans offer interest rates starting at 16% APR, and you can choose from repayment terms of 6 to 60 months. We also offer a variety of convenient ways to apply for a loan, including online, over the phone, or in person at one of our branches.

| TVS Credit Personal Loan Highlights | |

| Interest Rate | 16%-35% p.a. (annualized) |

| Loan Amount | Rs 50,000-Rs 7 lakh |

| Tenure | 6 months-5 years |

| Processing Fees | 2%-6% |

Benefits of choosing a TVS Personal Loan:

- Competitive interest rates

- Flexible repayment terms

- Convenient application process

- Easy online approval

- Same-day funding

If you’re looking for a low-interest personal loan, TVS Credit is the perfect choice for you. We can help you save money on your loan and get the financing you need to achieve your financial goals.

TVS Personal Loan Interest Rate

| Minimum Interest Rate | 16% p.a. (annualized) |

| Maximum Interest Rate | 35% p.a. (annualized) |

TVS Credit has not specified how interest rates vary based on credit score, monthly income, job profile, employer profile, work experience, etc. However, most lenders consider these factors when determining the interest rates on personal loans. Before submitting their final application, individuals applying for personal loans should compare the interest rates offered by as many lenders as possible.

How to Lower Your TVS Personal Loan Interest Rate

There are a few things you can do to lower your personal loan interest rate:

- Improve your credit score. A higher credit score will make you a more attractive borrower to lenders, and they’ll be more likely to offer you a lower interest rate.

- Shop around for the best rate. Compare interest rates from multiple lenders before you choose one.

- Consider a shorter loan term. A shorter loan term will typically have a lower interest rate than a longer loan term.

- Make a down payment. Making a down payment on your loan will reduce the amount of money you need to borrow, which can lower your interest rate.

Comparison of Personal Loan Interest Rate offered by Various Lenders

| Banks/NBFCs | Interest Rates(p.a.) |

| Axis Bank | 10.49% onwards |

| IndusInd Bank | 10.49% onwards |

| IDFC First Bank | 10.49% onwards |

| HDFC Bank | 10.50% onwards |

| ICICI Bank | 10.50% onwards |

| Kotak Mahindra Bank | 10.99% onwards |

| Tata Capital | 10.99% onwards |

| Bajaj Finserv | 11.00% onwards |

| Federal Bank | 11.49% onwards |

| DMI Finance | 12% – 36% |

| L&T Finance | 12.00% onwards |

| Kreditbee | 12.25% – 30% |

| MoneyTap | 12.96% onwards |

| Piramal Finance | 12.99% onwards |

| Aditya Birla | 13% onwards |

| MoneyView | 15.96% onwards |

| Cashe | 27.00% onwards |

How to Save Interest on Your Personal Loan

There are a few things you can do to save interest on your personal loan:

- Make your payments on time. Late payments can result in late fees and higher interest rates.

- Pay more than the minimum payment. Paying more than the minimum payment will help you pay off your loan faster and save money on interest.

- Consolidate your debt. If you have multiple loans with high interest rates, you can consolidate them into one loan with a lower interest rate.

- Consider a balance transfer. If you have a credit card with a high interest rate, you can transfer the balance to a card with a lower interest rate.

We hope this article has helped you learn more about TVS Personal Loan Interest Rates and how to save money on your loan. If you have any questions, please don’t hesitate to contact us.

Additional Read: 25 Best Instant Personal Loan Apps in India

Eligibility Criteria for TVS Credit Personal Loan

- Individuals with salaries in excess of Rs 30,000 are eligible for a TVS Credit Personal Loan.

- Individuals with a CIBIL score of over 700 have a greater opportunity to obtain a TVS Credit Personal Loan.

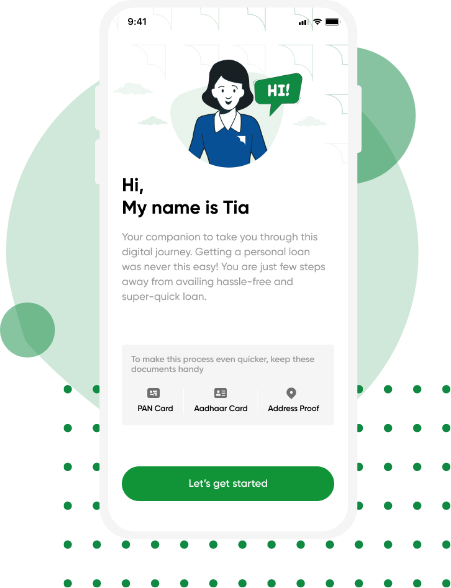

Documents Required for TVS credit Personal Loan

- PAN Card

- Aadhar Number

- Address Proof

How to Apply for TVS Credit Personal Loan

- Install the TVS Credit Saathi App on your mobile devices.

- Update your KYC information for verification and determine your eligibility for a personal loan.

- Choose loan amount and term and complete the video-based Know-Your-Customer procedure.

- Confirm your bank information and conclude the loan disbursement e-mandate process.

FAQs

What is the interest rate on a TVS Personal Loan?

The interest rate on a TVS Personal Loan will vary depending on your credit score, income, and other factors. However, interest rates typically start at 16% APR.

How can I lower my interest rate on a TVS Personal Loan?

There are a few things you can do to lower your interest rate on a TVS Personal Loan:

– Improve your credit score.

– Shop around for the best rate.

– Consider a shorter loan term.

– Make a down payment.

How can I save interest on my TVS Personal Loan?

There are a few things you can do to save interest on your TVS Personal Loan:

– Make your payments on time.

– Pay more than the minimum payment.

– Consolidate your debt.

– Consider a balance transfer.

What are the repayment terms for a TVS Personal Loan?

The repayment terms for a TVS Personal Loan can range from 6 to 60 months.

What are the benefits of a TVS Personal Loan?

Some of the benefits of a TVS Personal Loan include:

– Competitive interest rates.

– Flexible repayment terms.

– Convenient application process.

– Easy online approval.

– Same-day funding.

What are the requirements for a TVS Personal Loan?

The requirements for a TVS Personal Loan include:

– You must be at least 18 years old.

– You must have a valid Social Security number.

– You must have a steady income.

– You must have a good credit history.

How do I apply for a TVS Personal Loan?

You can apply for a TVS Personal Loan online, over the phone, or in person at one of our branches.

I hope this helps!