In recent years, the financial landscape in India has witnessed a significant transformation, with the advent of digital lending platforms. As traditional banking processes evolve, Reserve Bank of India RBI Approved Loan Apps in India have emerged as a popular choice for borrowers seeking quick and hassle-free access to funds. In this article, we will explore the benefits and safety measures associated with these RBI approved loan apps in India.

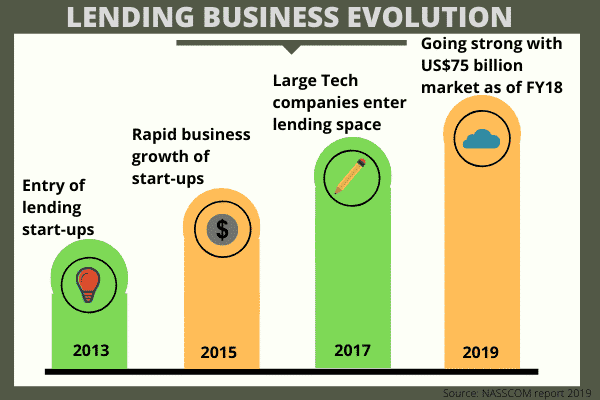

The Evolution of Digital Lending

The traditional approach to obtaining loans often involved lengthy paperwork, extensive documentation, and time-consuming verification processes. However, with the rapid advancements in technology, digital lending has become a game-changer in the financial sector. RBI Approved Loan Apps in India leverage the power of digital platforms to streamline the loan application process, making it easier for individuals to secure funds for various purposes.

Understanding RBI Approved Loan Apps in India

RBI Approved Loan Apps in India are mobile applications that comply with the guidelines and regulations set forth by the Reserve Bank of India. These apps function as a platform where borrowers can connect with legitimate lenders, facilitating quick loan approvals and disbursals. The RBI’s approval ensures that these apps adhere to the necessary security and data protection measures, making them a safe and reliable choice for borrowers.

Additional Read: Instant Personal Loans Using Aadhaar Card: A Hassle-Free Guide

RBI approved loan apps in India List 2023

When you need a quick loan, going to a typical bank may take some time because there is a tonne of paperwork and credit card interest rates are astronomically expensive. Additionally, approaching friends or family members could feel unpleasant.

Loans for salary advances are not very common in India. In such circumstances, applying for a personal loan is the best course of action. The list of RBI approved loan apps in india is provided below, which may make applying more simpler. To learn more about them, scroll down.

| S. No. | Name Of The Registered App | Credit Limit |

| 1 | Kreditbee Instant Loan App | Loan up to 2 Lakh |

| 2 | Kreditzy Instant Loan App | Loan up to 2 Lakh |

| 3 | Paysense | Loan up to 5 Lakhs |

| 4 | NAVI | Loan up to 5 Lakhs |

| 5 | Lazypay(Credit Line + Personal Loan) | Loan up to 1 Lakhs |

| 6 | Freopay | Loan up to ₹10000 |

| 7 | Stashfin | Loan up to 5 Lakh |

| 8 | Cashbean– Online Loan App | Loan up to 1 Lakhs |

| 9 | MI Credit | Above 5 Lakhs |

| 10 | Dhani Loan App | Loan up to 5 Lakh |

| 11 | Avail Finance | Loan up to ₹50000 |

| 12 | NIRA Instant Loan App | Loan up to 2 Lakh |

| 13 | Branch Loan App | Loan up to ₹50,000 |

| 14 | Smart coin Loan App | Loan up to 2 Lakhs |

| 15 | Rupeek App (Gold Loan) | Loan up to 50 Lakhs |

| 16 | Simpl Pay Later | Loan up to 1 Lakhs |

| 17 | Mobikwik (Credit Line + Consumer Loan) | Loan up to 2 Lakh |

| 18 | Paytm Personal Loan | Loan up to 2 Lakh |

| 19 | Krazybee (Consumer Loan) | Loan up to 2 Lakh |

| 20 | Bharatpe (Business Loan) | Loan up to 5 Lakh |

| 21 | Paytm Postpaid (Credit Line) | Loan up to 1 Lakhs |

| 22 | True Caller | Loan up to 5 Lakh |

| 23 | Simply Cash Loan App | Loan up to 2 Lakh |

| 24 | Slice | Loan up to 1 Lakhs |

| 25 | True Balance | Loan up to ₹50,000 |

| 26 | Zest M28oney (Consumer Loan) | Above 2 Lakh |

| 27 | Amazon P29ay Later | Loan up to ₹60,000 |

| 28 | Flipkart Pay Later | Loan up to ₹60,000 |

| 29 | Tata Capital | Above 10 Lakhs |

| 30 | Tata neu Credit card (Qik EMI Card) | ₹10000 to ₹150000 |

| 31 | Tata Neu App (Qik Personal Loan) | ₹10000 to ₹10,00,000 |

| 32 | Ola Money pay Later | ₹1500 to ₹20000 |

| 33 | Khatabook Instant Loan App | ₹50,000 to ₹0,00,000 |

| 34 | Jupiter credit limit | Loan up to ₹50,000 |

| 35 | OneCard Loan App | ₹10000 to ₹150,000 |

| 36 | Paisabazaar credit limit | ₹50,000 to ₹10,00,000 |

| 37 | imobile Pay Later | Loan up to ₹ 20,000 |

| 38 | SBI YONO APP | ₹1500 to ₹60000 |

| 39 | India IDFC First Bank Pay later | ₹1500 to ₹ 60000 |

| 40 | Bajaj Finserv App | ₹ 50,000 to ₹ 5,00,000 |

| 41 | Rufilo Loan App | ₹5000 to ₹25,000 |

| 42 | IBL FINANCE App | ₹5000 to ₹25,000 |

| 43 | Early Salary Instant Loan App | ₹ 8,000 to ₹ 500,000 |

| 44 | Money View | ₹10,000 to ₹ 5,00,000 |

| 45 | CASHe | ₹1,000 to ₹ 3,00,000 |

| 46 | mPokket | ₹500 to ₹30,000 |

| 47 | Stashfin – Credit Line & Loan | ₹1,000 to ₹5,00,000 |

| 48 | MoneyTap | ₹1,000 to₹60,000 |

| 49 | FairMoney Loan App | Loan up to 2 Lakh |

| 50 | KreditOne | ₹5000 to ₹25,000 |

| 51 | FlexSalary Instant Loan App | ₹5000 to ₹25,000 |

| 52 | DigiMoney– Online Loan App | ₹5000 to ₹25,000 |

| 53 | Indialends | Loan up to ₹5,00,000 |

| 54 | Mystro Loans & Neo Banking app | Loan up to ₹50,000 |

| 55 | Kissht: Instant Line of Credit | ₹10,000 to ₹ 1,00,000 |

| 56 | IndusMobile: Digital Banking | ₹5000 to 200,000 |

| 57 | Prefr: Get instant loan | ₹10,000 to ₹3,00,000 |

| 58 | InstaMoney Personal Loan | ₹5,000 to ₹25,000 |

| 59 | Swift Loan– Online Loan App | Loan up to ₹50,000 |

| 60 | RapidPaisa | ₹ 1,000 – ₹ 10,000 |

| 61 | CreditScore, CreditCard, Loans | Loan up to ₹ 5 Lakh |

| 62 | Bajaj MARKETS: Loan, Card, UPI | Loan up to ₹25 Lakhs |

| 63 | Fullerton India Credit Company Limited | Loan up to ₹25 lakhs |

| 64 | LoanFront | ₹2000 to ₹2 lakhs |

| 65 | Pocketly | Loan up to ₹10,000 |

| 66 | Bueno Loans | Loan up to ₹25000 |

| 67 | PayRupik– Online Loan App | Loan up to ₹20,000 |

| 68 | Loaney | ₹200 to ₹20,000 |

| 69 | RupeePark | ₹5,000 to ₹500,000 |

| 70 | Cash Planet – Online Loan App | ₹5,000 to ₹500,000 |

| 71 | CreditScore – PaisaBazaar | ₹ 1000 to ₹ 50,000 |

| 72 | Money Tap | ₹ 3000 to ₹ 5 lakh |

The Benefits of Using RBI Approved Loan Apps in India

- Convenience: One of the primary advantages of RBI Approved Loan Apps in India is the convenience they offer. Borrowers can apply for loans from the comfort of their homes, eliminating the need to visit a physical bank branch.

- Quick Approvals and Disbursals: With minimal documentation and automated verification processes, these apps offer swift loan approvals and disbursals, enabling borrowers to access funds promptly during emergencies.

- Flexible Loan Options: RBI Approved Loan Apps in India provide a range of loan options to cater to diverse financial needs, such as personal loans, business loans, education loans, and more.

- User-Friendly Interface: These apps are designed to be user-friendly, ensuring that even those with limited technological expertise can easily navigate the application process.

- Secure Transactions: The RBI’s approval guarantees that these apps follow robust security protocols, safeguarding the borrowers’ personal and financial information from unauthorized access.

- Transparent Terms and Conditions: RBI Approved Loan Apps in India are transparent about their terms and conditions, ensuring that borrowers are aware of the interest rates, repayment schedules, and any additional charges.

Additional Read: 10 Best Personal Loan Apps For Students in India

Safety Measures for Borrowers

While RBI Approved Loan Apps in India offer a secure borrowing experience, it is essential for borrowers to exercise caution and adopt best practices to further enhance their safety:

- Research the App: Before choosing an RBI Approved Loan Apps in India, conduct thorough research. Read user reviews and ratings to gauge the experiences of other borrowers.

- Verify the Lender: Ensure that the lender associated with the app is a legitimate financial institution or a registered non-banking financial company (NBFC) regulated by the RBI.

- Read the Privacy Policy: Review the app’s privacy policy to understand how your personal information will be used and protected.

- Avoid Sharing Sensitive Information: Legitimate loan apps will never ask for sensitive information such as passwords or PINs. Avoid providing such details to anyone claiming to represent the app.

- Check for Secure Communication: Ensure that the app communicates through secure channels, denoted by “https://” in the website URL.

Additional Read: Learn about 500+ fake loan app list and shield your finances

Conclusion

RBI Approved Loan Apps in India have undoubtedly revolutionized the lending landscape., offering a convenient and secure alternative to traditional borrowing methods. With quick approvals, flexible loan options, and robust security measures, these apps provide a seamless borrowing experience for individuals across the country. As long as borrowers remain vigilant and follow the necessary safety measures, RBI Approved Loan Apps in India can be a reliable and efficient solution for their financial needs.

FAQs

1. Are RBI approved loan apps available for both salaried and self-employed individuals?

Yes, RBI approved loan apps typically offer loan options for both salaried and self-employed individuals, subject to meeting the eligibility criteria.

2. How long does it take to get a loan approved through an RBI approved loan app?

The approval process can vary depending on the app and the borrower’s eligibility. However, many RBI approved loan apps provide instant approvals within a few minutes.

3. Can I apply for multiple loans through different RBI approved loan apps simultaneously?

While it is technically possible, it is advisable to apply for loans only when necessary and avoid taking on more debt than you can manage.

4. Are the interest rates on RBI approved loan apps competitive compared to traditional banks?

Yes, RBI approved loan apps often offer competitive interest rates, making them an attractive option for borrowers.

5. Can I repay the loan before the scheduled tenure without incurring additional charges?

Many RBI approved loan apps allow borrowers to prepay their loans without penalty. However, it’s essential to read the terms and conditions to confirm this facility.