Through the Navi Personal Loan App, you can obtain a frictionless Personal Loan online for up to Rs. 20 Lakhs with a flexible repayment period of up to 72 months. The APR for a Navi Personal Loan begins as low as 9.99% p.a., and the loan can be paid off early at no additional cost.

Navi Personal Loan Details

| Minimum Loan Amount | Rs. 10,000 |

| Maximum Loan Amount | Rs. 20 Lakhs |

| Tenure | 3 to 72 months |

| Rate of Interest | 9.9% p.a. |

| Processing Fee | 3.99% to 6% of the loan amount |

| Collateral | Not required |

| Foreclosure Charges | Nil |

Navi Finserv Personal Loan Features

- Online application for a Navi immediate personal loan up to Rs. 20 Lakh.

- The processing fee is between 3.99% and 6% (a minimum of Rs. 1,499 and a maximum of Rs. 7,499 + GST).

- The funds will be wired immediately to your bank account upon approval.

- There is no requirement for bank statements or pay stubs when applying for the loan.

- The complete Navi instant loan procedure is paperless.

- Required documentation is minimal.

- No document printouts are required.

- The interest rate on Navi app loans is affordable, beginning at 9.9% p.a.

- Flexible repayment terms up to 72 months and EMI options are available.

- Instantaneous online eligibility verification.

- There is no requirement for a security deposit or collateral to obtain the loan.

- Prepayment of the loan incurs no foreclosure charges.

- Online evaluations of Navi instant personal loan are available for your satisfaction and confidence.

Navi Personal Loan Interest Rate

The interest rates on Navi personal loans are fixed and range from 9.9% per annum, depending on the loan amount, repayment term, and applicant eligibility. In addition to the Navi interest rate, you will be required to pay a processing fee ranging from 3.99% to 6% (minimum of Rs. 1,499 and maximum of Rs. 7,499 + GST).

Read More: Navi Personal Loan Interest Rates: Compare Rates & Get Pre-Approved in Minutes [ Updated 2023]

Eligibility for Navi Personal Loan

Nationality: Indian citizenship is required.

Occupation: You can be either salaried or self-employed as a profession.

Age: Applicants must be between 18 and 65 years old to qualify for the loan. In some instances, the minimum age requirement can be increased to 21, 23, or 25 years of age.

Credit score: A minimum credit score of 650 is required to qualify for a Navi personal loan.

Location: Loan facility of Navi is presently only available in select cities, such as

- Andhra Pradesh: Visakhapatnam (Vizag), Ananthapur, Chittoor, Guntur, Krishna, East Godavari

- Bihar: Patna, Gaya

- Chandigarh

- Delhi NCR: New Delhi, Gurgaon, Noida, Greater Noida, Ghaziabad, Faridabad

- Gujarat: Ahmedabad, Vadodara, Valsad

- Haryana: Ambala, Karnal, Kurukshetra, Panchkula, Panipat

- Jharkhand: Ranchi

- Karnataka: Bangalore, Mysore, Udupi, Dharwad, Kolar, Hassan, Mandya

- Kerala: Ernakulam, Kollam, Kottayam, Thiruvananthapuram, Thrissur

- Madhya Pradesh: Indore

- Maharashtra: Mumbai, Navi Mumbai, Thane, Pune, Nagpur, Ahmed Nagar, Kolhapur, Aurangabad, Nashik, Satara

- Odisha: Bhubaneshwar, Cuttack

- Pondicherry

- Punjab: Amritsar, Ludhiana, Jalandhar, Mohali, Ropar, Bathinda, Fatehgarh Sahib

- Rajasthan: Jaipur, Udaipur, Ajmer, Alwar, Kota, Jhujhunu

- Tamil Nadu: Chennai, Tiruchirappalli, Erode, Madurai, Vellore, Salem

- Telangana: Hyderabad, Secunderabad, Mahabubnagar

- Uttar Pradesh: Ghaziabad, Noida, Lucknow, Jhansi

- Uttarakhand: Dehradun

- West Bengal: Kolkata, Hoogly, Howrah.

Navi Personal Loan Document Required

To request for a personal loan at Navi app, you need only the following documents:

- PAN number

- Aadhaar number.

How to Apply for Navi Loan?

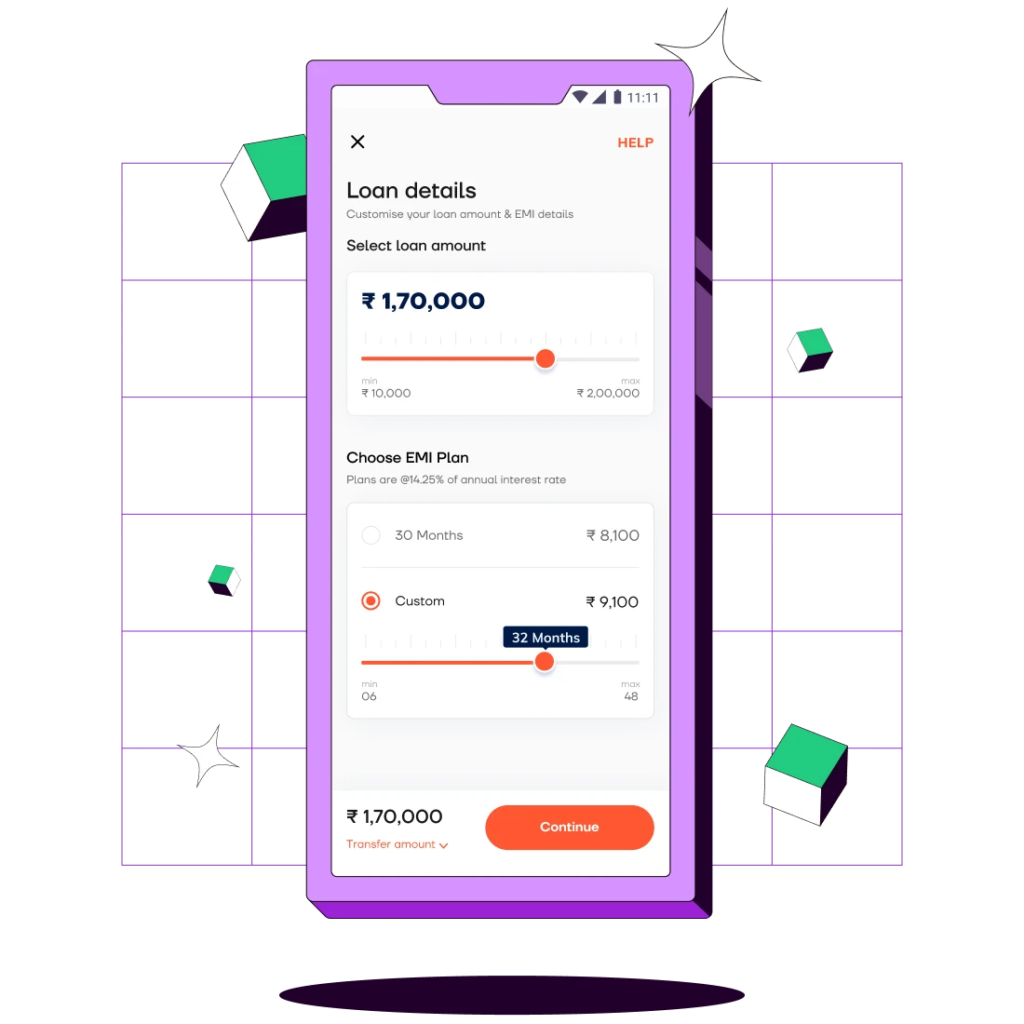

Obtaining a personal loan through a loan application like Navi is incredibly simple and fast. Here are the necessary steps:

- Download and install the loanable Navi app from Google Play (for Android users) or the App Store (for iOS users) on your mobile device.

- Register your mobile phone number.

- Fill out some essential information to determine your eligibility for a personal loan.

- Select the loan and monthly payment amount.

- Complete the Know Your Customer (KYC) process with a Selfie, Aadhaar, and PAN numbers.

- Enter your bank account information for a money transfer online.

- Receive immediate funds transferred to your bank account from the Navi instant personal loan application.

Navi Finserv Personal Loan Contact Details

You can reach Navi for Navi app loan-related questions, complaints, and feedback via the following channels:

Send email at: help@navi.com

Visit or write to Navi at their office address:

Navi Technologies Pvt Limited

3rd Floor, Salarpuria Business Center,

93, 5th A Block, Koramangala

Bangalore – 560095