Kreditzy Personal Loan app is a distinguished online lending platform designed to provide swift and convenient access to personal loans. With its user-friendly interface and simplified application process, Kreditzy aims to ease the borrowing experience for its customers.

What are instant online loans?

Instant online loans are loans that can be obtained at the time of need without collateral by submitting an online application. Kreditzy was instrumental in developing an online platform that allows salaried and self-employed individuals to obtain a loan between Rs. 1,000 and Rs. 1 lakh for a variety of purposes within minutes by submitting an online application.

Simply complete out the application with your personal information, upload your KYC documents, and provide a reference and bank account number. Various data points will be used to collect information about your financial status, personal status, and employment status, and a technology-based assessment instrument will be used to analyse and generate a credit score. Kreditzy has revolutionised the credit landscape by introducing the ability to obtain loans in minutes with a single click.

Additonal Read: 25 Best Instant Personal Loan Apps in India

Why getting a loan from Kreditzy is a good idea?

Getting a loan from Kreditzy has a number of benefits, as shown below:

Small-ticket to big-ticket loans: Kreditzy lets you choose between a small-ticket loan of up to 1,000 rupees and a big-ticket loan of up to 1 lakh rupees. You can figure out what you need and get a loan based on that. This makes it easy and cheap to pay back the loan instead of leaving you with a debt you can’t pay back. You can pay back the loan and get another loan. Personal Loans can be taken out more than once, as long as the first loan is paid back in full by the due date.

Simple and with little paperwork: Online, you can fill out a loan application, send in the papers needed to process the application, sign the documents, and get the loan money. The process is easy and doesn’t use any paper at all. This helps get the loan paid out faster. After you make a request, the amount you need will be added to your account within 15 minutes.

Rate of interest: The interest rate is based on how long the loan is for. The interest rate for short-term loans (up to 30 days) ranges from 18% to 35.95% p.a., while the rate for longer-term loans (more than 30 days) is 29.95% p.a.

Fast disbursement: If you ask for a personal loan online, the money can be in your account in as little as 10 minutes. From signing up to getting the loan, the whole process takes only 10 minutes.

Collateral-free: To get a personal loan from Kreditzy, you don’t have to worry about giving a personal guarantee or any other kind of collateral protection. This is because the loan you get is an unsecured loan.

Loans from Kreditzy and What They Offer

Kreditzy’s online platform for obtaining a personal loan has simplified and streamlined the credit application process.

The following are the features of Kreditzy’s personal loan:

Purpose: The available loan amount ranges from Rs. 1,000 to Rs. 1 lakh, making it a versatile loan in terms of its intended use. It can be used for anything from the payment of utility expenses as low as 1,000 rupees to the purchase of a high-end gadget or vehicle costing between 250,000 rupees and 1.00 lakh rupees. The loan may be used for any purpose, including school fees, vehicle maintenance, a family vacation, the purchase of a gift, and minor home repairs, among others.

Quantity: Kreditzy will provide loans ranging from 1,000 rupees to one million rupees.

Interest: The interest rate for a loan payable within 30 days will range from 18% to 35.95% per annum, while the interest rate for a loan payable in months will be 29.95% per annum.

Repayment: The loan may be repaid between 30 days and 12 months.

Processing charges: Processing fees are proportional to the selected repayment period. It ranges between 100/- and 1,000/-. Processing fees are assessed at a fixed rate.

Pre-payment charges: The loan can be paid off early at any time without incurring any fees.

How to apply for a loan through Kreditzy?

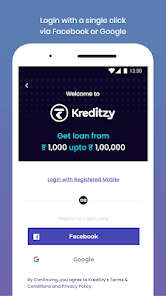

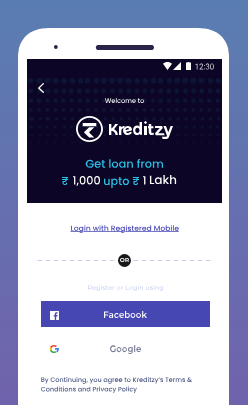

Download the Kreditzy mobile application from the Google Play Store in order to register for a personal loan through Kreditzy. You must register via Facebook or Google, verify your eligibility, complete the KYC procedure, and provide transaction details. This concludes the application procedure, and the funds will be deposited into your account shortly.

The entire procedure takes only 10 minutes. The actions that must be taken are described in detail below.

Registration:

- You must sign up for the Kreditzy app through your Google or Facebook account.

- Enter and validate your name, phone number, and email address.

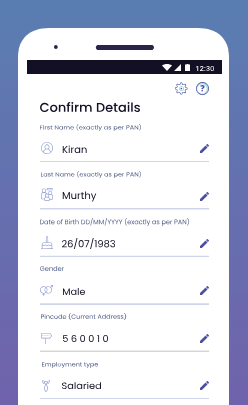

Eligibility check

- Provide your Pan No.

- Provide essential information such as your monthly income, date of birth, and current zip code.

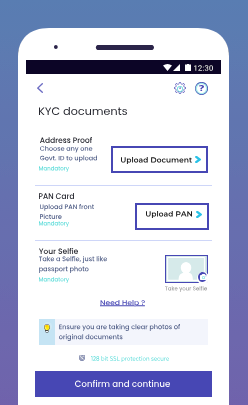

Complete the KYC

- You must upload your KYC documents.

- Provide and affirm your current and permanent addresses, as well as your marital status.

- You should provide a reference and the reference’s contact information.

Make available transaction Details

- Provide information about your bank account.

- E-signatures are used to complete documentation.

Disbursement

- Within 15 minutes, the quantity will be credited to your bank account.

- Make expeditious payments by the due date and you will be eligible for higher limits.

Documents required

KYC documents: Pan Card, Aadhar Card Voter’s ID Card, Passport, etc

For proof of address and photo identification, any of the above may be submitted.

The submission of a Pan Card is required in order to verify your credit score and other financial status-related parameters.

Eligibility Criteria for loans through Kreditzy

The eligibility requirements for financing through Kreditzy are as follows:

- The applicant must be an Indian resident

- The applicant’s age must fall between 21 and 45 years old.

- The minimum essential monthly income is 10,000/-

- A minimum of three months’ experience with the current employer will be required.

- Both salaried and self-employed individuals qualify for the loan.

Who are Kreditzy’s lending partners?

To offer its consumers simple loans, Kreditzy has partnered with top financial institutions like private and public sector banks, NBFCs, and other Private Finance Companies. Additionally, Kreditzy and Krazybee Services Private Limited have teamed to offer personal loans to customers in the shortest amount of time.

What you can do with a quick online loan

Numerous uses are possible for Kreditzy’s rapid online financing. The loan can be used for small, short-term crises like paying energy bills, making up for late EMIs, paying school tuition, maintaining a vehicle, etc. It can also be used for other purposes, such as organising a family vacation, purchasing a gift for a loved one, shopping, treating yourself at a spa, signing up for fitness training, performing modest home repairs and renovations, meeting business needs, etc.

How to repay Kreditzy loan?

The Kreditzy app’s Repayment option can be used to repay the loan. Net banking, debit cards, Paytm Wallet, UPI, and bank transfers are all options for making online payments. Except for bank transfer, all other payment methods will include convenience charges based on the amount. It is advised to pay by bank transfer in order to avoid convenience fees, which will raise the cost of your loan.

The alternative would be to direct your bank account to automatically debit funds. Only once you have given Kreditzy the auto-debit information and received confirmation that the auto-debit has been successfully set up on your account will this take effect.

Kreditzy Instant Loan FAQs

What is the maximum loan amount offered by Kreditzy Personal Loan?

Kreditzy Personal Loan offers loan amounts ranging from [Specify minimum amount] to [Specify maximum amount], catering to diverse financial needs.

Can self-employed individuals apply for Kreditzy Personal Loan?

Yes, Kreditzy Personal Loan extends its services to both salaried professionals and self-employed individuals.

How quickly are the funds disbursed?

Utilizing advanced algorithms, Kreditzy often disburses approved loans within minutes of approval.

Is a good credit score required for loan approval?

While a good credit score can enhance eligibility, Kreditzy considers various factors beyond just the credit score.

Can I prepay the loan before the tenure ends?

Yes, Kreditzy encourages early repayment without imposing any prepayment penalties, helping you save on interest costs.

What is the minimum loan amount available through Kreditzy Personal Loan?

Kreditzy Personal Loan offers loan amounts starting from [Specify minimum amount], ensuring options for various financial needs.

Is there a processing fee associated with Kreditzy Personal Loan?

Kreditzy Personal Loan may have a nominal processing fee, which varies based on the loan amount and other factors.

Can I apply for a loan from Kreditzy if I have an existing loan from another lender?

Yes, you can apply for a Kreditzy Personal Loan even if you have existing loans, as long as you meet the eligibility criteria.

What if I face difficulty in repaying my Kreditzy Personal Loan on time?

In case of repayment difficulties, it’s recommended to reach out to Kreditzy’s customer support to discuss possible solutions.

Is there a mobile app available for tracking my loan and payments?

Yes, Kreditzy offers a user-friendly mobile app that allows you to track your loan details, EMIs, and payment history.

Can I change the repayment date after the loan is approved?

Generally, the repayment date is fixed upon loan approval. Contact Kreditzy’s customer support to discuss any exceptional circumstances.

Is there an age limit for applying for a Kreditzy Personal Loan?

Yes, there is usually an age limit for loan eligibility. Make sure to check the specific age range provided by Kreditzy.

What happens if I miss an EMI payment for my Kreditzy Personal Loan?

Missing an EMI payment can result in penalties and negatively impact your credit score. It’s advisable to make payments on time.

Can I apply for a Kreditzy Personal Loan if I’m a freelancer with irregular income?

Yes, Kreditzy Personal Loan extends its services to self-employed individuals, including freelancers with varying income patterns.

Is there an option to change the loan tenure after approval?

Typically, the loan tenure is fixed upon approval. If you have specific concerns, it’s best to contact Kreditzy’s customer support.

How secure is the personal and financial information I provide during the application process?

Kreditzy employs advanced security measures to safeguard your personal and financial information, ensuring confidentiality.

Can I apply for a Kreditzy Personal Loan if I have multiple loans from different lenders?

Having multiple loans from different lenders can affect your creditworthiness. Kreditzy’s approval may depend on your overall financial situation.

What are the options for contacting Kreditzy’s customer support?

You can contact Kreditzy’s customer support through their website, mobile app, or provided contact details for assistance.

Can I change the loan amount after the application is submitted?

Once the application is submitted, changes to the loan amount might not be possible. It’s crucial to provide accurate information initially.

Is there a customer referral program with Kreditzy Personal Loan?

Kreditzy may offer customer referral programs where you can refer others and receive benefits upon their successful loan approval.

Can I apply for a Kreditzy Personal Loan if I’m a student?

Kreditzy Personal Loan primarily caters to salaried professionals and self-employed individuals, so student eligibility may vary.

What is the tenure range for Kreditzy Personal Loan?

The tenure range for Kreditzy Personal Loan typically extends from [Specify minimum tenure] to [Specify maximum tenure].

Is there an option to change the EMI due date during the loan tenure?

Generally, the EMI due date is fixed at the beginning of the loan tenure. You may contact Kreditzy’s customer support for any inquiries.

Can I track my loan application status online?

Yes, you can track the status of your loan application through Kreditzy’s website or mobile app using the provided tracking tools.

What types of documents are required for identity verification during the loan application?

Documents such as your Aadhar card, PAN card, and address proof are usually required for identity verification during the application process.

Are there any penalties for late payments of EMIs?

Late EMI payments may result in penalties, affecting your credit score and overall repayment experience.