KreditBee is a leading online lending platform that specializes in offering instant personal loans to salaried professionals and self-employed individuals. With its user-friendly interface and streamlined application process, KreditBee aims to simplify the borrowing experience for its customers.

KreditBee Personal Loan Details

| Interest Rates | 1.02% p.m. |

| Loan Amount | Rs. 1,000 – Rs. 4,00,000 |

| Tenure | 3 Months – 24 Months |

| Loan Processing Fee | 0% – 6% of the sanctioned loan amount |

| Turnaround time | Entire process from registration to disbursement takes maximum 15 minutes. |

| Purpose | Medical emergency, domestic functions, education, travel, payments of existing debts & insurance, and other financial emergencies. |

Kreditbee App

The KreditBee App provides salaried individuals with instant personal loans of up to Rs. 2 Lakhs against their salary to assist them in meeting their imperative financial needs.

The entire procedure, from registration to disbursement, is completed online and does not exceed 15 minutes. These Personal Loans are accessible online via the KreditBee website and mobile app (downloadable from the Google Play Store on Android devices).

KreditBee is a technology-based intermediary that facilitates Personal Loans from regulated lenders to individuals with minimal documentation and instant funds disbursement upon approval.

Currently, the KreditBee loan app provides Flexi Personal Loan, Personal Loan for Salaried, Online Purchase Loan, and E-voucher Loans.

KreditBee Personal Loan Interest Rates

The interest rate charged by KreditBee varies depending on the form of loan you seek. The loan interest rate for Flexi Personal Loan, Personal Loan for Salaried, Personal Loan for self-employed, and purchase on EMI ranges from 1.02% p.m. to 2.49% p.m.

Note: Examine the available finest personal loan app in India.

KreditBee Personal Loan Features and Benefits

Flexible loan amount: Loan amounts are flexible, ranging from a minimum of Rs. 1,000 to a maximum of Rs.4 Lakhs to meet your urgent financial requirements.

Low interest rates: KreditBee’s personal loan interest rates are extremely competitive, ranging from 1.02% p.m. to 2.49% p.m.

Minimal processing fees: The processing fee for these loans ranges from 0% to 6% of the loan list amount.

Flexible tenure: You can repay your KreditBee Loan over a repayment period spanning from 62 days to 15 months.

No prepayment or foreclosure fees: You can make prepayments and pay off the loan early without incurring any additional costs.

User-friendly application: On Android devices, the KreditBee app can be downloaded via the Google Play Store. The registration process is also straightforward. You can sign in using your Google or Facebook account and are only required to affirm the provided personal information.

Minimal processing time: Flexi Personal Loans can be disbursed to your bank account within 15 minutes, assuming all submitted documents and information are complete and accurate. Personal loans to salaried borrowers may take up to three business days to disburse.

Complete online process: The entire loan application and repayment procedure is conducted online. You can access your account at any time and from almost any location.

Loans for first-time applicants: Even individuals with no prior loans or other credit facilities are able to obtain an online loan from KreditBee. By making timely payments on these loans, you can establish a solid credit history and score.

Types of KreditBee Loans

Here are some different types of quick loans from KreditBee:

Following are different types of KreditBee instant loans:

- Flexi Personal Loan

- Loan amount: Rs. 1,300 – Rs. 1,00,000

- Tenure: 2 months – 10 months

- Personal Loan for Self-Employed

- Loan amount: Rs. 40,000 – Rs. 1,50,000

- Tenure: 3 months – 12 months

- Personal Loan for Salaried

- Loan amount: Rs. 10,000 – Rs. 4,00,000

- Tenure: 3 months – 15 months

- Online Purchase Loan/ E-voucher Loans/E-commerce Shopping Loans

- Loan amount: Rs. 1,000 – Rs. 2,00,000

- Repayment tenure: 18 months

Additional Info: Check Best Loan Apps for Student in India.

Eligibility Criteria For Kredit Bee Personal Loan

To be qualified for a personal loan You must meet the following requirements to use KreditBee:

- You must be at least 21 years old and no more than 45 years old.

- You must be a citizen of India.

- You must be salaried or have another source of monthly income.

- You must have an Aadhaar-linked mobile number in order to receive an OTP for e-signing the loan agreement from UIDAI.

- You must have the required KYC and address verification documents.

- You must have a PAN Card as proof of identity.

- You must have a Facebook or Google account to sign up for and access the KreditBee app.

- You must have been engaged by the organisation for at least three months.

- You must earn a minimum of Rs. 10,000 per month.

- You must be the Primary Account Holder of a legitimate Savings Bank Account.

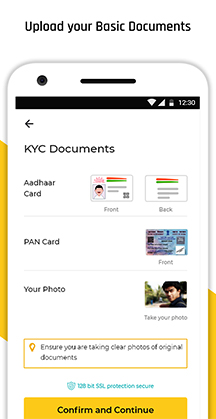

Documents Required For Kredit Bee Loan

The following are the required documents for a KreditBee personal loan application:

- PAN Card for Credit Score and other financial parameters verification.

- Address verification: Aadhaar card, masked e-Aadhaar, voter ID, passport, or driver’s licence

- Salary proof

- Employment proof

- Payroll account bank statement.

- Salary statements

- You must provide certain information, including your biographical information, references’ contact information, and employment information.

How to Apply Kredit Bee Personal Loan

To apply for a KreditBee Personal Loan, simply complete the steps listed below:

- Install the KreditBee mobile application from Google Play.

- Register using your Facebook or Google account.

- Fill out your essential information to determine your eligibility for a Personal Loan through the KreditBee app.

- An “eligibility successful” page will be displayed for you, and an SMS confirming this will be issued to your registered cellphone number (this procedure could take up to 24 hours). Within one working day after submitting your application, KreditBee will call you.

- You will be needed to upload your KYC documents and complete a few additional fields after your eligibility has been verified.

- Your profile will be confirmed depending on the validity and quality of the uploaded documents after you have uploaded the KYC documents and provided other supporting documentation.

- You can apply for a loan on KreditBee and sign a loan agreement once all of your information has been verified.

- The money will be transferred to the bank account you give within 15 minutes of signing the loan agreement.

- From the following month on, you can pay the borrowed amount via KreditBee online.

Alternately, you can use the same procedure to apply on KreditBee’s website.

KreditBee Personal Loan Application Status

Download the KreditBee app for Android mobile if you already have a loan with KreditBee that is due.

By login into the Instant Loan App with your KreditBee credentials, you may see the status of your KreditBee personal loan application.

To find out the progress of your personal loan application, call the KreditBee customer service line at 080-44292200.

Why should I choose Personal Loans from KreditBee?

- Get instantaneous personal loans in under 15 minutes.

- A credit limit that is high dependent on your credit score and payment history

Personal loans of up to Rs.3 lakhs for any purpose - There are no restrictions on the loan’s final use.

- Flexible payment alternatives

- purely online procedure

- Simple requirements for documentation

KreditBee Customer Care

You can contact KreditBee Customer Care using any of the following methods:

- KreditBee personal loan customer care number: 080-44292200 (anytime between 10AM to 7PM from Monday to Saturday, except public holidays).

- E-mail: help@kreditbee.in

The Grievance Redressal Officer will try to resolve your grievance within 14 days from the date of receipt of a grievance.

KreditBee Personal Loans FAQs

What is the maximum loan amount offered by KreditBee?

KreditBee offers loan amounts ranging from INR 1,000 to INR 2,00,000, catering to diverse financial needs.

Can self-employed individuals apply for KreditBee personal loans?

Yes, KreditBee extends its services to both salaried professionals and self-employed individuals.

How quickly are the loans disbursed?

KreditBee’s advanced algorithms enable instant approval, often resulting in loan disbursement within minutes of approval.

Is a good credit score mandatory for loan approval?

While a good credit score can enhance eligibility, KreditBee considers various factors beyond just the credit score.

What if I want to repay the loan before the tenure ends?

KreditBee encourages early repayment without any prepayment penalties, helping you reduce interest costs.

Can I apply for a KreditBee personal loan if I have no credit history?

Yes, KreditBee considers various factors beyond just credit history, providing opportunities for individuals with limited credit history.

Are there any hidden charges associated with KreditBee personal loans?

KreditBee maintains transparency and aims to minimize hidden charges, ensuring borrowers are aware of all associated costs.

What is the minimum and maximum repayment tenure for KreditBee personal loans?

The repayment tenure for KreditBee personal loans ranges from 2 months to 15 months, providing flexibility to choose a suitable tenure.

Can I use the loan amount for any purpose I want?

Yes, the loan amount can be utilized for various personal needs, including medical emergencies, education expenses, weddings, and more.

Do I need to provide a guarantor to secure a KreditBee personal loan?

No, KreditBee personal loans are unsecured, eliminating the need for a guarantor.

What documents are required for the KYC process?

The KYC process typically requires your Aadhar card, PAN card, and a recent photograph.

Is the KreditBee app available for both Android and iOS devices?

Yes, the KreditBee app is available for download on both Android and iOS platforms.

Can I apply for multiple loans simultaneously from KreditBee?

KreditBee typically allows one active loan at a time. Once the existing loan is repaid, you can apply for a new one.

How is the loan amount disbursed if I don’t have a bank account?

Having a bank account is essential for loan disbursement as the funds are directly transferred to your account.

Is there a penalty for missing an EMI payment?

Missing an EMI payment can result in penalties and adversely impact your credit score. It’s advisable to pay EMIs on time.

Can I change the repayment tenure after loan approval?

Once the loan is approved and disbursed, the repayment tenure is generally fixed and cannot be changed.

Do KreditBee personal loans have a prepayment penalty?

No, KreditBee encourages early repayment and does not impose any prepayment penalties.

Can I apply for a loan if I’m residing in a different city than my permanent address?

Yes, you can apply for a KreditBee personal loan from a different city, as long as you meet the eligibility criteria.

Are there any customer reviews available for KreditBee personal loans?

Yes, you can find customer reviews and testimonials on the KreditBee website or app.

What if I need an extension for repaying my KreditBee personal loan?

If you encounter difficulties in repaying, it’s recommended to contact KreditBee’s customer support to discuss possible solutions.

Can I increase my loan amount after I’ve already received a loan from KreditBee?

Generally, you need to repay your existing loan before applying for a new one with a higher amount.

Is there a limit to the number of times I can apply for KreditBee personal loans?

KreditBee may have restrictions on the frequency of loan applications to ensure responsible borrowing.

Are KreditBee personal loans available for students?

KreditBee personal loans are primarily designed for salaried professionals and self-employed individuals.

How do I know if my loan application has been approved?

You will receive a notification on the KreditBee app and through email regarding the status of your loan application.

Can I make part-payments towards my KreditBee personal loan?

KreditBee typically requires full EMI payments. However, you can contact customer support to discuss any exceptional circumstances.