You can quickly and easily apply for a personal loan without providing any security, collateral, or guarantors. However, the lending institution considers a number of variables when you apply for a personal loan to establish your eligibility. One of the most important variables that NBFCs take into account is your credit score because it shows how likely you are to be approved for a loan and make on-time payments.

Typically, lenders prefer to approve loan applications from borrowers with excellent credit ratings. Due to the low risk associated for the lender, such candidates receive better loan terms and cheaper interest rates. But what if you’re looking for a personal loan with a poor CIBIL score? Low-score applicants are typically viewed as hazardous by loan providers, who are likely to reject their applications. You still have a chance to receive a personal loan, even though having a poor CIBIL score lowers your prospects. Here are some important details about loans with poor CIBIL scores.

- What is CIBIL stands for?

- What Determines a CIBIL Score?

- CIBIL Score for Personal Loans: Its Importance

- Obtaining a Personal Loan with a Low CIBIL Score is Possible

- Qualifications For Personal Loans With Low Cibil Scores

- Low Interest Rates on Cibil Loans

- Low Cibil Score Instant Personal Loan Application

- What Else Lowers the CIBIL Score?

- Keep your credit score from declining further.

- FAQ:

What is CIBIL stands for?

Cibil stands for Credit Information Bureau (India) Limited. According to your current liabilities and income, your credit score represents your spending patterns and shows how well you manage credit. Based on your payback history, credit type, duration, current credit liabilities, and credit exposure, credit bureaus produce a number between 300 and 900. A lower score denotes ineffective credit management, whereas a better score positions you as a creditworthy applicant and enhances the likelihood that your loan application will be approved.

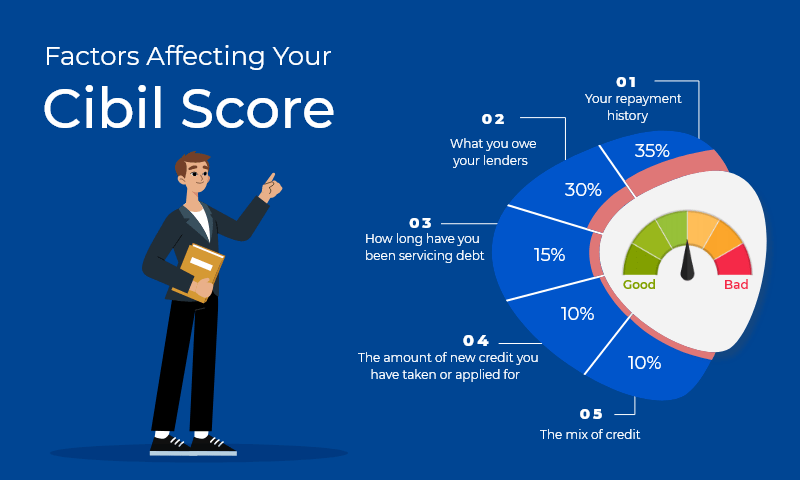

What Determines a CIBIL Score?

According to the following, CIBIL determines the credit score by:

- Repayment history: 30%

- Credit exposure: 25%

- Credit type and duration: 25%

- Credit inquiries and applications: 20%

In order to preserve a high credit score while searching for low credit score loans, one should pay all bills and loan EMIs on time, keep the credit utilisation ratio below 30%, diversify one’s credit portfolio, and only borrow when necessary.

CIBIL Score for Personal Loans: Its Importance

A respectable credit bureau, CIBIL, has been given permission by the RBI to determine credit scores for anyone applying for credit. Your credit worthiness is strongly indicated by your CIBIL score, which spans from 300 to 900 and influences the likelihood of approval. It relies on your history of repaying previous obligations, the length and variety of your credit history, etc. By keeping your credit score high, you position yourself as the ideal applicant for future loans. A low credit score, on the other hand, makes it more difficult to get approved and persuades the lender to charge higher interest rates. Hero FinCorp takes into account a number of additional aspects when establishing a borrower’s eligibility for a personal loan, such as income, job stability, DTI ratio, etc.

Additional Read: Everything you need to know about the charges associated with a Personal Loan

Obtaining a Personal Loan with a Low CIBIL Score is Possible

Using information about your credit history, credit limit, repayment history, and other characteristics, the CIBIL score evaluates your credit portfolio. Because of this, we examine your credit score to determine your ability to make payments and risk level. While many people think it’s hard to receive a loan with a low CIBIL, there are certain steps you may do to change that.

- Show That You Have a Good Income to Make Reliable EMI Payments

Our staff may be persuaded to take your application for a quick loan despite a low CIBIL score if you have received a pay raise or have another source of income. Telling our team that you have a solid work and income may persuade them to approve the loan regardless of your credit rating. When you demonstrate your eligibility for a Personal Loan in this way, the interest rate can be higher.

- Request a Smaller Loan Amount

The risk to the loan provider increases when a borrower applies for a large loan amount with a poor credit score. If you don’t make your payments, we will suffer a significant loss as the lender. However, requesting a lesser loan because of a poor CIBIL score lowers our risk and gives us more confidence to approve it.

- Apply with a co-applicant or obtain a guarantor

By adding a co-applicant or guarantor with a respectable CIBIL score, obtaining low credit score loans becomes simpler. Our confidence in approving the application will improve because of their income and reputation, which will raise your eligibility. However, keep in mind that locating a guarantor or co-applicant requires work because they will be responsible for repaying the loan in the event of a default. Apply jointly with someone who has a high credit score to Hero FinCorp for a personal loan if you have a poor CIBIL score.

- Verify and correct any errors in the credit report.

It’s possible for CIBIL reports to have identification, financial, credit history, repayment, and other types of inaccuracy. Without your fault, such errors could lower your credit score. Because of this, it’s crucial to regularly check your credit report for problems and report them so that they can be fixed. You are entitled to one free CIBIL report per year, which you must carefully review and correct if necessary. By doing that, the credit score will increase and the likelihood of receiving a personal loan without a CIBIL check would increase.

- Demanding that NA or NH be taken into consideration in your credit report

The credit report’s NA or NH entry denotes the lack of any credit-related activity over the previous 36 months. In such a case, the CIBIL report may have zero or very low credit scores. So talk to us, explain your credit inactivity, and take the NA or NH in the credit report into consideration. The loan might be approved by our group, but it might come with a higher interest rate.

Additional Read: Personal Loan on Credit Card: A Comprehensive Guide

Qualifications For Personal Loans With Low Cibil Scores

Worried about your low CIBIL score but looking for a personal loan? Do not worry! For people with bad credit, we have lenient eligibility requirements in place. What you need to know is as follows:

- Employment Type: We encourage both paid employees and independent contractors to apply.

- Age requirements: You must be at least 21 years old and not older than 58 years old to be eligible.

- Low CIBIL Score Supportive: We are aware that everyone can experience financial problems. You still have a chance to get a personal loan even with bad credit.

Our objective is to help people who need it most financially. Therefore, explore the possibilities with our individualised loan alternatives regardless of your credit background. Don’t let a poor CIBIL score prevent you from applying; do it now to get one step closer to realising your goals.

Additional Read: Bank of Baroda Personal Loan

Low Interest Rates on Cibil Loans

In search of affordable CIBIL loan interest rates? We have your back! At Hero FinCorp, we are aware of how important affordability is to you. You can now get loans with reduced interest rates that are suited to your financial demands thanks to the competitive rates. With our simple application process, we can quickly approve your request and disburse the money you require for a personal loan even if your credit score is low. Take advantage of our low CIBIL loan interest rates today to easily reach your financial objectives and stop letting exorbitant interest rates hold you back. What are the prices?

| Fees and Charges | Range |

|---|---|

| Interest Rate | 15% – 35% |

| Foreclosure Charges | 5% + GST |

| Processing Fees | 2.5% – 3.5% |

Low Cibil Score Instant Personal Loan Application

One of the greatest solutions in India is the fast Personal Loan app from Hero FinCorp (formerly known as SimplyCash). It makes it possible for you to swiftly obtain a personal loan without having your CIBIL score checked. You can receive up to Rs 1.5 lakh in cash instantly into your bank account when you borrow it. You can select a payback period of between 6 and 24 months on the app, which offers reasonable interest rates. It’s ideal for meeting any kind of financial necessity, including paying for vacation or medical expenditures. Now that you have the Hero FinCorp instant personal loan app, you may quickly and easily borrow money without worrying about your CIBIL score.

Additional Read: 12 Different Types of Loans You Must Know

What Else Lowers the CIBIL Score?

Your CIBIL score might be considerably lowered by a few things.

- Credit Repayment History: Missed payments or defaults have a negative effect on your CIBIL score.

- Owe to lenders: A high credit utilisation rate and outstanding debts can both affect your CIBIL score.

- Credit Age: Your CIBIL score may be negatively impacted by a limited credit history or recently opened credit accounts.

- Errors in your CIBIL Report: False information in your CIBIL report may cause an unjustified decline in your credit score.

Keep your credit score from declining further.

Do not panic or worry if your credit score is poor. Implement these measures to stop the score from declining further, in addition to working to raise it and looking for ways to secure a cheap CIBIL loan:

- Avoid taking any more loans

- Use credit cards sparingly

- Repay overdue loan EMIs and credit card bills

- Improve your budgeting

- Ensure continuous report monitoring

FAQ:

- What is the CIBIL score need for a personal loan?

Different CIBIL score criteria may apply to personal loans. However, applicants often need to have a score of 650 or more in order to receive a favourable loan approval. A lower score could lead to increased interest rates or possibly the loan application being rejected.

- Is it possible to obtain a personal loan with a 500 credit score?

A credit score of 500 can make getting a personal loan difficult. When it comes to loan approval, lenders frequently choose borrowers with higher scores, but there are still alternative options available.

- Can I obtain a loan in India with a credit score of 450?

A credit score of 450 makes it difficult to obtain a loan in India. For loan acceptance, lenders favour candidates with higher scores. Improve your credit score before asking for a loan to increase your likelihood of being approved.

- Am I eligible for a personal loan with a credit score of 532?

Some lenders might nevertheless issue personal loans even though a credit score of 532 is thought to be below average. However, compared to candidates with higher credit scores, the interest rates and loan terms might not be as enticing.

- How do you pick a lender with a bad credit rating?

Consider these elements when choosing a lender with a low credit score: Seek out lenders (like Hero FinCorp) who specialised in serving borrowers with bad credit. Compare the costs, terms, and interest rates. Make sure the lender sends credit bureau records so you may start to rebuild your credit. To determine their repute, ask for referrals and check reviews.

- Why does making on-time payments cause my credit score to drop?

Despite the importance of paying on time, a number of things might lower your credit score. These can include using a lot of credit, accruing a lot more debt, making late payments recently, or having bad information on your credit record. Maintaining a balanced credit mix and checking your credit report for inaccuracies are crucial.

- Which online loan application with a low CIBIL score is the best?

There are a number of reliable online loan applications available for people with poor CIBIL scores. Hero FinCorp’s fast Personal Loan app (formerly SimplyCash) is one of the most well-liked options; it provides speedy loan approvals, flexible payback terms, and convenient digital processes, making it the perfect option for people with bad credit.