In today’s fast-paced world, financial stability is crucial for achieving our dreams and aspirations. Personal loans have become a popular choice for individuals looking to fulfill their immediate financial needs. However, with so many options available and numerous myths circulating, it’s essential to understand the ins and outs of personal loans. In this article, we will delve into the world of personal loans, debunk misconceptions, and provide you with valuable insights into this financial instrument.

- Characteristics of the Top Personal Loan Banks

- Benefits of Personal Loans

- HDFC Personal Loan

- Fullerton India Personal Loan

- Private Bank Personal Loan

- SBI Personal Loan

- Kotak Mahindra Bank Personal Loan

- Tata Capital Personal Loan

- Citibank Personal Loan

- Standard Chartered Bank Personal Loan

- Capital First Personal Loan

- IIFL Personal Loan

- HDBFS Personal Loan

- Personal Loan Eligibility

- Documents Required for Personal Loan

- Other Fees & Charges for Personal Loan

- Personal Loan for Army Personnel

- Personal Loan for Pensioners

- Today’s Personal Loan Rates for Women

- How to Submit a Successful Personal Loan Application

- Different Types of Personal Loans in India

- Need a Personal Loan? Boost your Chances

- Personal Loan Prepayment and Partial Payment

- What to do next after a Personal Loan is closed?

- The Different Personal Loan Repayment Methods

- Pre-approved Personal Loans

- How to Check Personal Loan Status?

- Where Can I Find a Personal Loan Statement?

- How to Keep a Personal Loan from Being Rejected?

- Personal Loan Top-Up

- Key features and benefits

- Personal Loan Balance Transfer

- Personal Loan – Reducing Balance Vs. Flat Interest Rate Method

- How Much Can You Save on a Personal Loan Balance Transfer?

- Payment Comparison of EMI for Reducing Balance vs. Flat Rate

- What is the maximum possible repayment term for a personal loan?

- What Function Does a Credit Report Serve in Approval of a Personal Loan?

- What effect does credit score have on the APR and loan amount of personal loans?

- Is it Still Possible to Get a Personal Loan with a Credit Score Below 750?

- What other factors, outside credit history, affect the approval of a personal loan?

- What are a Few of a Personal Loan’s Benefits and Drawbacks?

- How is Total Cumulative Interest Calculated?

- What advice do you have for obtaining a low PL Interest Rate?

- What are a few strategies for lowering the total amount of interest paid?

- Is it possible to get pre-qualified for a personal loan?

- Personal Loan Disbursal

- FAQs (Frequently Asked Questions)

Characteristics of the Top Personal Loan Banks

| Feature | HDFC Bank | Private Bank | Bajaj Finance |

| Interest Rate | 10.49% – 17% | 11.25% – 18.5% | 12% |

| Min Loan Amt | Metro : 100000 & Non Metro: 100000 | 100000 | 100000 |

| Max Loan Amt | 50 Lacs | 50 Lacs | 1 Cr |

| Loan Tenure | 1 – 6 Years | 1 – 5 Years | 1 – 5 Years |

| Processing Fee | 0.25% – 2% of the Loan Amt | 1% – 2.5% of the Loan Amt | 0.5% – 2% of the Loan Amt |

| Preclosure Charges | 2%, Nil foreclosure charges after 12 months | 2%, Nil foreclosure charges after 24 months | Nil |

| Overdraft Facility | No | No | Yes |

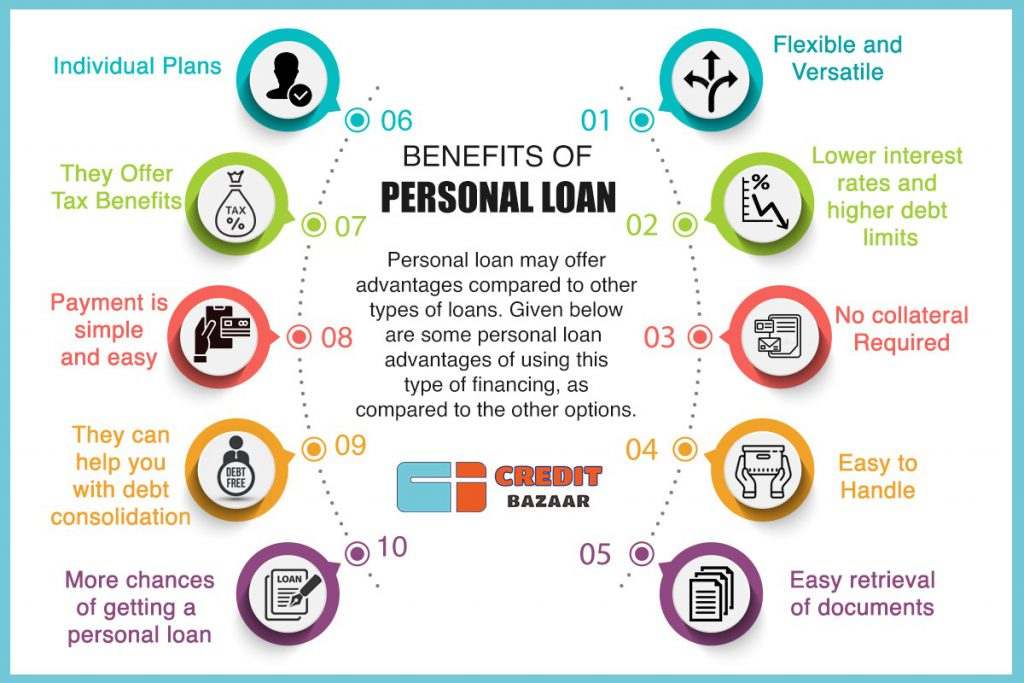

Benefits of Personal Loans

- You can take the loan for Rs.40 lakh or more.

- Choose a loan tenure of up to 5 years and repay your loan in easy EMIs.

- You can apply through Offline or Online modes.

- Less paperwork and low documentation are required.

- No restrictions on how the loan amount should be used.

- Affordable interest rates ranging between 10% – 24% p.a.

- Helps in quick consolidation of debts.

- Fast Approval.

- Pre-approved loan offers are also available.

Compare several banks that offer loans at a reasonable interest rate, a safe EMI, and minimal processing fees if you’re looking for a loan. Some of the top banks are listed below:

HDFC Personal Loan

Key Features:

- Beneficial personal loan Interest rates for applicants who are self-employed.

- Loan Disbursement for pre-approved HDFC Bank Applicants is completed in 10 seconds.

- Flexible Repayment terms of up to five years.

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 10.50% onwards | Rs.2,149 | Salaried- 13-24 months – 4% of principal outstanding,25-36 months – 3% of principal outstanding>36 months – 2% of principal outstanding | Rs.1,28,963 |

Fullerton India Personal Loan

Key Features:

- Effortless and Rapid Approvals based on Personal Loan Eligibility

- Flexible terms ranging from 1 year to 5 years.

- Existing Fullerton India customers are eligible for additional perks and the process is simple and requires minimal paperwork.

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 11.99% | Rs. 2,633 | 3% to 7% of the outstanding amount of principal depending on the time of application of foreclosure | Rs. 1,26,380 |

Additional Read: All About Fullerton India Personal Loan

Private Bank Personal Loan

Key Features:

- Without-collateral personal financing

- Receive money in just 3 seconds*

- Minimal personal loan documentation and a straightforward application procedure

*Applicable only to pre-approved consumers following online verification and bank acceptance of the final offer*

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 10.5% onwards | Rs.2,149 | 5% of the total principal outstanding amount + GST | Rs.1,28,963 |

SBI Personal Loan

Key Features:

- Without-collateral personal financing

- Low interest rates

- Minimal paperwork, hassle-free processing, and the use of a personal loan EMI calculator will simplify the process.

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 9.60% onwards | Rs.1832 | 3% of the total principal outstanding amount + GST | Rs. 1,31,939 |

Read More: All About SBI Personal Loan

Kotak Mahindra Bank Personal Loan

Key Features:

- Minimal documentation

- Competitive rates of interest and flexible repayment options

- Uncomplicated and rapid loan disbursement

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 10.75% onwards | Rs.2,162 | Effective 1st Aug 2021, below foreclosure charges, will be applicable to all personal loan customers:– 0 to 12 Months : Lock-in Period – 1 to 3 years : 4% + GST on principal outstanding– 3 years onwards: 2% + GST on principal outstanding | Rs.1,29708 |

Tata Capital Personal Loan

Key Features:

- Simple and Rapid Financing at Variable Interest Rates

- The loan may be used for any purpose, including financing medical emergencies, marriages, etc.

- Flexible EMI payment options that accommodate your needs, budget, and schedule.

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 10.99% | Rs.1903 | 4.5% of the Principal outstanding at the time of foreclosure + GST Foreclosure charges for a closing loan within 6 months will be 6.5% + GST If foreclosed within 6 months post completing part pre-payment: Foreclosure changes will be 4.5% of the Principal outstanding at the time of foreclosure + GST + Part pre-payment amount | Rs.1,31,204 |

Additional Read: Tata Capital Personal Loan Interest Rates [Updated 2023]

Citibank Personal Loan

Key Features:

- Low Interest Rates for Employed and Self-Employed Applicants

- Typically, funds are deposited into your bank account within 48 hours.

- Minimal documentation and immediate approval for Citibank customers

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 9.99% onwards | Rs.2,124 | Up to 4% of the total outstanding principal amount plus the amount of interest for the month in which foreclosure is done | Rs.1,27,452 |

Standard Chartered Bank Personal Loan

Key Features:

- Attractive interest rate on personal loans

- Rapid approval when applying online

- Flexible repayment terms of up to five years

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 11.49% onwards | Rs.2,199 | 0-12 Months- 5% of the Principal Outstanding.12-24 Months- 4% of the Principal Outstanding.25-36 Months- 2% of the Principal Outstanding.Over 36 Months- 1% of the Principal Outstanding | Rs.1,31,956 |

Read More: All About Standard Chartered Bank Personal Loan

Capital First Personal Loan

Key Features:

- It is an ideal option if you wish to add additional funds to your personal loan.

- The loan’s repayment period is convenient, extending from 1 to 5 years.

- The confirmation of the loan takes only about two minutes, saving you time and granting you immediate access to the funds.

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 10.49% onwards | Rs.2149 | 5% of the principal outstanding amount | Rs.1,28,933 |

IIFL Personal Loan

Key Features:

- The eligibility can be verified in one minute, and the online approval can be obtained in no more than five minutes after submitting the required documents and form.

- Within eight hours, the loan amount is disbursed and deposited into your bank account.

- The documentation process is also relatively straightforward, and the required paperwork is minimal, saving you time and effort.

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 24% | Rs.2,877 | Up to 6% of the outstanding principal amount | Rs.1,72608 |

HDBFS Personal Loan

Key Features:

- Special offers for personnel of specific businesses.

- The processing of the personal loan is quick, and neither a guarantor nor collateral is required in order to obtain the loan.

- The terms are also adaptable, ranging from one to five years.

*The calculation of EMIs and total payment is based on the assumption that the loan amount to be repaid is Rs. 1 Lakh and the loan term is 60 months. Interest rates can vary depending on the applicant’s income and the quantity borrowed.

| Interest Rate | EMI | Foreclosure/Prepayment Charges | Repayment |

| 30-36% | Rs.2,378 | 2% to 4% of the outstanding amount of principal based on the date of application of foreclosure | Rs.1,42,708 |

Personal Loan Eligibility

| Criteria | Salaried | Self-Employed |

| Age | 21 to 60 years | 22 to 55 years |

| Net Monthly Income | Rs.15,000 | Rs.25,000 |

| CIBIL Score | More than 750 | More than 750 |

| Minimum Loan Amount | Rs.50,000 | Rs.50,000 |

| Maximum Loan Amount | Rs.40 Lakh | Rs.50 lakh |

Documents Required for Personal Loan

The following list includes the necessary essential documents:

| Requirements | Salaried Individuals | Self Employed |

| Proof of Identity | Passport, Voter’s ID, Driving License or PAN Card | Passport, Voter’s ID, Driving License or PAN Card |

| Proof of Residence | Utility bills or Passport | Utility bills or Passport |

| Proof of Income | Bank statement of salary account for the previous six months | Audited financial statement of the previous two years |

The following papers must be provided to the lender if you are an NRI seeking a personal loan:

- Your Recent passport-size photographs and of the guarantors

- Copy of your Passport

- Visa Copy

- Bank Statements

- Your work Email ID or the Email ID of the HR of the company.

- Salary Certificate or salary slips

- Proof of Identity, Residence, Income, and Assets

- NRO/NRE bank statements of the previous 6 Months

RBI has announced a moratorium extension for EMIs

Other Fees & Charges for Personal Loan

- Processing fee

- Goods and Services Tax or GST

- Verification charges

- Charges levied for issuing a duplicate statement

- Penalty for defaults

- Penalty for pre-payment and part payment of a loan

In addition, the lender may impose additional fees for documentation, credit, stamping, collection, administration, etc.

| Bank | Processing Fee | Prepayment Charges |

| HDFC Bank | 0.25% to 1.50% | 2%, Nil foreclosure charges after 3 months |

| Axis Bank | 0.50% to 1.50% | Nil |

| Private Bank | 0.25% to 1.50% | 2%, Nil foreclosure charges after 9 months |

| SBI | 500/- to 0.50% | Nil |

| Kotak Bank | 1% to 2% | 2.25% of foreclosure amount if closed 1 month ahead of the tenure. |

| IIFL | Nil | Nil |

| Muthoot Finance | Nil | Nil |

| Manappauram Bank | Nil | Nil |

| PNB | 0.70% to 1% | Nil |

| Canara Bank | 0.01 | Nil |

| Andhra Bank | Nil | Nil |

To check Personal Loan Interest Rate for all major banks you can visit: Personal Loan Interest Rates

Personal Loan for Army Personnel

People who have completed exceptional service in the Defence forces, such as the Army, Navy, and Air Force, typically face a difficult road ahead when beginning over and turning over a new leaf. Although they are guaranteed a fixed income for the remainder of their lives in the form of pensions, subsidies, and other perks, they prefer not to remain inactive and may want to continue working by getting a job or starting their own business. There are numerous financing options available to military personnel, including bank loan products and government loan programmes.

The majority of commercially chartered banks offer personal loans with concessional interest rates to army personnel. There are numerous banks that offer up to Rs.10 lacs in personal loans to members of the armed forces. You can select terms ranging from 1 to 5 years, and partial prepayments incur no additional fees. Some institutions provide complimentary accident insurance with personal loans. Some commercial institutions’ personal loan offerings are outlined below:

| Bank Name | Interest Rates (per annum) | Tenure | Loan Amount |

| Andhra Bank | 11.70% | 12-60 months | Up to Rs. 5 Lacs |

| Oriental Bank | 11.50% | Up to 60 months | Up to Rs. 5 Lacs or 15 times of Net take-home salary |

| IDBI Bank | 12.99%-13.49% | 12-60 months | Up to Rs. 10 Lacs |

In addition to these banks, you can obtain personal loans from nationalised institutions, which offer the most advantageous loan options. In addition, the processing fee is minimal or waived for these institutions’ personal loans for military personnel.

Personal Loan for Pensioners

People in retirement may experience a financial setback that compels them to obtain a loan. Numerous banks offer loans to retirees in an effort to assist them. The utmost age for Central or State government or military pensioners eligible for this loan is 77 years old. They may obtain loan approval from any branch of the institutions from which they receive their pension. The personal loan can be used to satisfy their individual financial requirements. Among the most important characteristics of personal loans for retirees are:

- Processing fees are nominal, ranging between 0.5% and 1% of the total loan amount. Pensioners are exempt from paying any processing fees.

- A quick loan processing time.

- The interest rate is 3.8 percent above the 2-year MCLR. This is presently between 11.45 and 12.5% annually.

- There are no additional interest charges.

- Prepayment fees: If the loan amount is repaid prior to the end of the term, a 3% prepayment fee of the loan amount must be paid.

- The minimum loan quantity for federal government employees is Rs. 25,000. The maximum pension is 18 months, with differing maximums for various age groups.

- The minimum loan quantity for defence employees is Rs. 25.000. For pensioners younger than 56 years of age, the utmost pension is 36 months with a cap of 14 lakhs. It is also an 18-month pension with differing upper limits for various age groups.

Today’s Personal Loan Rates for Women

On personal loans, a number of prominent lenders offer discounted interest rates to women borrowers. This action was taken to increase the notion of financial independence among women in our country. These discounted rates can empower women and increase their employment opportunities, whether salaried, self-employed, or entrepreneurial. Listed below are some of the best personal loan lenders with the lowest interest rates:

| Bank | Interest Rate | Processing Fee |

|---|---|---|

| PNB | 8.95% -11.80% | 1.8% + Taxes |

| SBI | 9.60% -16.40% | 1.00% |

| Kotak Bank | 10.40% -17.99% | Starting from Rs.999 |

| Yes Bank | 10.40% -20.00% | Min-Flat Rs.2021 |

| Axis Bank | 10.49% -16.75% | Up to 1.75%,Min Rs.4,999 |

How to Submit a Successful Personal Loan Application

- Assess the need for your loan

- Do proper research to get the best offer

- Check your credit score

- Check the fine print on your loan document

- Based on the repayment ability, select your tenure

- Choose an affordable rate of interest

- Select your loan amount as per your needs

- Review your EMIs properly

- Review the processing fee

- Choose between fixed or variable interest rates based on your preferences.

| Do’s | Don’ts |

| Do proper research before you apply for a loan | Don’t sign your loan documents without understanding every point |

| Do read the fine print carefully | Don’t make multiple inquiries regarding loans from different banks |

| Do save your money carefully when you are repaying | Don’t take a personal loan without any serious purpose |

| Do pay your loan installment promptly every single time | Don’t be in a hurry to end your loan comparison process |

| Do evaluate your credit score thoroughly | Don’t forget to pay your loan installments |

| Do apply for an affordable loan amount | Don’t accept bad loan products |

Different Types of Personal Loans in India

Personal loans can be used for any purpose that is permissible. However, certain lenders offer varying loan products based on the purpose specified by the applicant on the loan application. In India, you can obtain a variety of personal loans based on your needs:

Personal Loan (Wedding): A loan offered primarily to cover wedding expenses is a wedding Personal Loan.

Personal Loan (Home Renovation): A home renovation loan is used to cover the expense of home renovation or repair.

Personal Loan (Vacations): A vacation loan is designed specifically for vacations. You can take out a loan for your vacation and pay it back in simple installments at a later date.

Personal Loan (Pensioners): Personal Loan (Pensioners) refers to a loan that is offered specifically to elderly.

Personal Loan (Festivals): Some banks offer a personal loan for festivals only. You can apply for a festival loan if you need a personal loan to make accommodations for a festival celebration.

Need a Personal Loan? Boost your Chances

Rebalancing your debts and incomes: In order to determine your debt-to-income ratio, lenders require proof of income when you apply for a personal loan. To increase your annual income, consider selling liquid assets such as securities or earning more through a part-time position. This will increase your debt-to-income ratio and your likelihood of obtaining a loan.

Credit Improvement: Your credit score is the most important factor that lenders consider. A high credit score makes obtaining a personal loan more convenient. If your credit score is low, you must examine your credit reports for errors. Occasionally, simple errors can lower your scores, and if you discover any, you must disclose them to CIBIL.

Limit Your Borrowing: It is hazardous to borrow more money than you need to meet your financial obligations. You should calculate the quantity you require and apply for only that amount.

Consider Co-Signers/Guarantors: If you are unable to qualify for a personal loan on your own, you may submit an application with a guarantor or co-signer. You must choose a guarantor with a high CIBIL score. The primary objective of a guarantor is to ensure that you will repay your loan. However, they are responsible for repaying the loan if you are unable to do so. Choosing a cosigner with a credit score above 750 is advantageous, as it substantially improves your prospects of obtaining a personal loan.

Choose the Appropriate Lender: Each lender has its own set of income and credit score requirements. When searching for these types of loans, choose a lender whose eligibility requirements you can meet and submit an application accordingly. The disadvantage of using multiple lenders is that each of them will verify your credit score. Every time your complete credit report is requested, your credit score falls slightly.

Personal Loan Prepayment and Partial Payment

The loan repayment tenure for a personal loan is typically a fixed amount of time. The applicant must make regular monthly EMI payments during this time. Foreclosure or pre-payment occurs when the applicant chooses to repay the loan amount before the term has expired. Generally, there are 2 sorts of prepayment:

Full Prepayment

Full-repayment occurs when the borrower settles the entire balance of the loan before the end of the term.

Advantages of Full Prepayment

- You can avoid paying interest by fully prepaying your loan if the lender does not impose any kind of penalty for early repayment.

- Avoid paying high loan interest.

- Always a wonderful thing, paying off the loan.

Disadvantages of Full Prepayment:

- If you intend to foreclose on your debt, some lenders could impose steep fees.

- You also receive some tax advantages when you pay your loans’ EMIs on time. Your best course of action in these situations might not be to foreclose on your loan.

| Lenders | Prepayment Charges | Prepayment Norms |

|---|---|---|

| HDFC Bank | Prepayment when made between 13th-24th months – 4% of the principal outstandingPrepayment when made between 25-36 months – 3% of the principal outstandingPrepayment when made after 36 months – 2% of the principal outstanding | The Full or part pre-closure application can be processed only after the successful payment of the first 12 Equated Monthly Installments (EMIs)Part-prepayment allowed upto 25% of the principal outstanding. You can part pay only once in the financial year and twice during the loan tenure. The charges for the same will apply to the part payment amount |

| Private Bank | 5% of the principal outstanding | Prepayment allowed only after the successful payment of the first 12 EMIs or morePart-prepayment not allowed |

| Kotak Mahindra Bank | 5%-6% of the principal outstanding | Lock-in period- 12 monthsHowever, the bank allows prepayment before the lock-in period. If you do so, the upper charge limit of 6% is applicable. Else you will pay 5% |

| IndusInd Bank | As applicable | Prepayment allowed only after the successful payment of the first 12 EMIsNo part-prepayment allowed |

| YES Bank | Prepayment when made between 13-24 months – 4% of the principal outstandingPrepayment when made between 25-36 months – 3% of the principal outstandingPrepayment when made between 37-48 months – 2% of the principal outstandingPrepayment when made after 48 Months – NIl charges2% on the part payment amount when you opt for part prepayment | Prepayment in full or parts allowed after the successful payment of the first 12 EMIs |

| IDFC First Bank | 5% of the principal outstanding when making a full prepayment of either simple or smart personal loans2% of the principal outstanding when making a part prepayment of smart personal loans | Part prepayment not allowed in simple personal loansPart prepayment allowed upto 40% of the principal outstanding once in a financial year under smart personal loans. You can avail of this facility post three 3 successful EMI payments |

Part Pre-Payment

Part prepayment is what is used when the applicant only repays a portion of the total loan amount.

Advantages of Partial Prepayment:

- It will lower both the principal loan balance and the EMI payment.

- Additionally, the overall interest rate will be decreased.

Disadvantages of Partial Prepayment:

- You can be charged a high fee by your lender for the early pre-payment.

What to do next after a Personal Loan is closed?

Even if you pay off your debt partially or in full, you are still responsible for the balance. After you have paid off all of your debts, you must take the following actions:

- No dues certificate: The lender will provide you a No dues certificate as confirmation that your loan has been paid off once you have made all the payments necessary to cover the amount owed on it. One of the most important documents you need to get from your lender is this one. The lender will send the certificate to your registered address if loan payments are made by cheque or NEFT.

- Statement of Account: Not all lenders offer a Statement of Account because it is optional in nature. You can utilise a Statement of Account to make the appropriate adjustments in the event that there are discrepancies in the CIBIL score.

- Unused checks: The closing of a personal loan often comes to a close with the collecting of the unused checks and the no dues certificate.

It is also advised that you review your CIBIL score once the loan application process is complete.

The Different Personal Loan Repayment Methods

From bank to bank, the loan repayment method may differ. However, the following are the principal, regularly used modes:

- Post Dated Cheques: Post-dated cheques are those that are written out to pay back debts at a given future date and for a defined amount.

- Electronic Clearance System: This method of loan payback involves transferring money electronically from one bank to another.

- National Automated Clearing House: NACH, is a model for real-time transactions and is provided by NPCI.

- Debit Mandate or standing instruction: You can order your bank to send payments to another bank on a regular basis by giving it a debit mandate or standing instruction.

Pre-approved Personal Loans

If you currently work with a lender, you can apply for pre-approved personal loans without having to complete any paperwork. By the time you have a relationship with the lender, whether it be through a loan or a savings account, they will have the necessary documents. If you have a credit card, savings account, home loan, or any other relationship with the lender, you may be eligible for a pre-approved personal loan.

How to Check Personal Loan Status?

Following your application, you may be interested in the most recent status of your personal loan. Dialabank is available to help you! The committed executives will keep you informed of your loan’s status. The executives will let you know if the lender approves of the loan. The notification is also available through email.

On the official website of the lender, you may also check the status. When you applied for a personal loan online, you should have received an SMS with an application reference number that you must input before you may check the situation.

Online mode: You can log in to online portals provided by all major banks and NBFCs to check the status of your loan application.

Offline mode: You can visit the branch to inquire about the loan or call your lender to find out the status of your personal loan.

Where Can I Find a Personal Loan Statement?

You can check the online web portal for the same or go to the lending bank’s location to acquire your loan statement. The majority of websites let you see your personal loan statement through your registered email by entering the account number and other necessary information.

How to Keep a Personal Loan from Being Rejected?

Your request for a personal loan could be denied for a variety of reasons. However, if you meet the qualifying requirements—including those for age, income, and a decent CIBIL score—and produce all the required documentation, including confirmation of your address and income, you can avoid being rejected.

Personal Loan Top-Up

You can apply for a top-up loan in addition to your current loan if you already have one. This loan will have the same loan term as your previous loan and its interest rate could increase by 1% from the rate on your current loan.

Key features and benefits

- The loan top-up is available to current clients who have made on-time EMI payments and have no outstanding balances.

- The sum of the top-up loan is disbursed promptly or instantly.

- A minimal amount of documentation is needed.

- Numerous lenders provide fee-free processing.

- Collateral is not necessary.

Personal Loan Balance Transfer

The outstanding loan balance can be moved to another lender at a reduced interest rate through a process known as a transfer of the personal loan balance. A personal loan has a maximum term of five years, so balancing savings will only be considerable if the new interest rate is almost three to four percentage points below the current rate. The new bank will charge a fee for any balance transfer transactions. In this method, you must calculate before applying for the transaction described above.

- There are low interest rates accessible.

- Option to get a top-up personal loan.

- Take advantage of a number of incentives, including no processing fees and the waiving of prior EMIs.

Personal Loan – Reducing Balance Vs. Flat Interest Rate Method

| Methods | Reducing Balance Method | Flat Interest Rate Method |

| Method of Calculation | EMIs are calculated only on the principal amount that is outstanding after each prior payment. | EMIs are calculated on the original amount that is borrowed, i.e. the entire loan principal. |

| EMI Payout | Individual EMI payouts decrease with each successive EMI payment made by the borrower. | Individual EMI payouts remain constant over time. |

How Much Can You Save on a Personal Loan Balance Transfer?

To gain a feel of the savings possible with a balance transfer, think about the scenario below.

Example: Mukesh Kumar has taken an INR 8 lakh personal loan at an annual rate of 16%. Two years have passed until now since the loan which he took for five years. He receives a balance transfer offer from a new lender at a rate of 12 percent per year. How many funds can he secure if he uses the balance transfer option? Check the table given to find out more:

| Repayment Aspects | Details |

|---|---|

| Loan Amount | INR 8,00,000 |

| EMI Payable at 16% | INR 19,454 |

| Interest Payable at 16% Over 5 Years | INR 3,67,267 |

| Interest Paid @16% Till 2 Years | INR 2,20,266 |

| Outstanding Loan Balance at the End of 2 Years | INR 5,53,358 |

| New EMI @12% | INR 18,379 |

| Interest Payable @12% Over the Next 3 Years | INR 1,08,301 |

| Interest Paid Till 2 Years + Interest to be Paid Over the Next 3 Years | INR 3,28,567 |

| Savings in Terms of EMI | INR 1,075 (19,454-18,379) |

| Savings in Terms of Interest Outgo | INR 38,700 (3,67,267-3,28,567) |

Payment Comparison of EMI for Reducing Balance vs. Flat Rate

Using various time periods, interest rates, and loan amounts, the following table compares the EMI payable with declining balance and flat-rate methods of interest calculation:

| Personal Loan Specifics | EMI for Reducing Balance Method | EMI for Flat Rate Method | Interest savings over loan tenure* |

| Rs. 50,000 @ 10% for 3 years | Rs. 1,613 | Rs. 1,806 | Rs. 6,919 |

| Rs. 1 lakh @ 14% for 5 years | Rs. 2,327 | Rs. 2,833 | Rs. 30,390 |

| Rs. 2 lakh @ 16% for 4 years | Rs. 5,668 | Rs. 6,833 | Rs. 55,933 |

| Rs. 1.5 lakh @ 15% for 1 year | Rs. 13,539 | Rs. 14,375 | Rs. 10,035 |

What is the maximum possible repayment term for a personal loan?

Personal loans have a minimum repayment period of 12 months and a maximum repayment period of 7 years.

What Function Does a Credit Report Serve in Approval of a Personal Loan?

Since personal loans are unsecured, banks look at credit reports to try to reduce the risks. Lenders examine borrowers’ credit histories and track their loan repayment behaviour over time by looking at their credit reports. The bank or other financial institutions can now comprehend the borrower’s credit discipline thanks to this. Additionally, this aids the bank in determining if the borrower poses a high or low risk.

What effect does credit score have on the APR and loan amount of personal loans?

| Credit Score | Best Average APR | Best Average Loan Amount |

| 760+ | 10% | 1,465,975.00 |

| 720-759 | 12% | 1,321,040.00 |

| 680-719 | 18% | 1,012,941.00 |

| 640-679 | 24% | 8,36,822.00 |

Although offers differ depending on the lenders, the information above may help you determine your credit score before applying for a personal loan. The amount of your potential monthly payment based on your credit score can also be more easily calculated with the help of personal loan calculators.

Is it Still Possible to Get a Personal Loan with a Credit Score Below 750?

A personal loan cannot be guaranteed for any given credit score. A borrower with a score of more than 750 is more likely to get approved for a personal loan. A score just a little under 750 does not guarantee that a personal loan application will be approved.

The borrower is not qualified for a personal loan if their credit score is between 300 and 599. This is so because a low score warns a lender that the borrower has a poor history of credit behaviour.

There is a chance that some lenders will accept a credit score between 600 and 749, although it is not a high score. Lenders may take into account additional elements that will affect the borrower’s ability to repay the loan in the future, such as the stability of the borrower’s career, annual income, and the size of other liabilities. It is advised to keep your score above 750 if you plan to apply for a personal loan.

A credit score of 750 or above increases the likelihood of getting a loan. Additional advantages of a high score include a quicker approval procedure, a larger loan amount, and the ability to negotiate a cheaper interest rate.

What other factors, outside credit history, affect the approval of a personal loan?

Your employment is another important consideration throughout the loan approval procedure. Due to the lack of security or collateral required for personal loans, lenders must ensure that borrowers have a consistent monthly income during the loan term in order for them to be able to make timely payments to the bank. This is the rationale behind closely monitoring the borrower’s employment situation.

Lenders will consider if you’ve held down a consistent job for a certain amount of time. Someone who has a history of frequently changing jobs may not be eligible for a loan because this indicates that he or she may or may not have a reliable source of income during the loan term and may not be able to make timely payments.

The annual salary is another factor. The borrower’s ability to pay back the loan on a monthly basis with a respectable income (from a salary and other sources) is what the banks are looking for.

What are a Few of a Personal Loan’s Benefits and Drawbacks?

A personal loan has the following benefits: there is no cap on the amount that can be borrowed; no collateral is needed; application is significantly simpler than for a home or auto loan. Therefore, even if a person does not have any assets to offer as security, such as a house, stocks, or gold, they can still apply for this loan option.

The higher interest rate of a personal loan is its major drawback in comparison to other loans. Lenders charge high interest rates to offset the risk of their lending because they are not protected from payment default.

How is Total Cumulative Interest Calculated?

The annual interest on a loan can be calculated using the formula:

I = P x (R/100)

Where, I = Interest payable, P = Principal (loan outstanding) and R = Rate of Interest (annual percentage rate)

If the loan is for more than one year, the formula can be employed and the principle on the loan may change during the course of the loan’s repayment. The cumulative total interest for a personal loan is then determined by adding the various interest rates for each year. Use an EMI calculator, which can rapidly give you information like the total interest owed on your house loan, to avoid making such difficult calculations.

What advice do you have for obtaining a low PL Interest Rate?

The interest rate for a personal loan is lower if the lender believes the borrower to be financially responsible. The following are some of the methods you might be able to receive a personal loan with a low interest rate:

- Maintain a high credit score and clean credit history

- Have minimal outstanding debt i.e. credit utilization ratio of 30% or less

- Apply for a personal loan with a bank/financial institution with whom you already have a relationship

- Opt for secured personal loans

What are a few strategies for lowering the total amount of interest paid?

The following three methods will help you reduce your loan’s overall interest payment even when getting the lowest interest rate on a personal loan is not possible:

- Opting for a shorter tenure – Higher individual EMI but lower overall interest payout

- Part pre-payment/foreclosure – Decreases the loan principal thus interest payout is lower

- Opting for a lesser loan amount – Lower loan principal equals lower total interest payout

Is it possible to get pre-qualified for a personal loan?

Yes, consumers can get pre-approved for a personal loan online in a matter of minutes. You only need to provide some personal information, including the quantity of the loan you require, your income, address, and other factors. You can then readily determine which loans you are likely to qualify for and compare their rates and terms to find the best deal.

Personal Loan Disbursal

The typical requirements for approval of a personal loan are outlined above. If you satisfy these requirements, you pass the preliminary examination and may submit an application for the loan. But what will determine the actual quantity of the disbursement? It will be determined to a larger extent by your income. However, your ability to repay will be more crucial. Those with a higher income have more repayment options than those with a lower income.Lenders also consider the proposed ratio of monthly net income to proposed EMI. This tells them a great deal about the debtors’ ability to repay.

Lenders will most likely authorise a loan amount that does not exceed 50% of your gross monthly income. The obligation encompasses all forms of debt, including the loan you must service. If you are presently servicing one or more loans, your eligibility may be restricted compared to those who have no debt obligations.

FAQs (Frequently Asked Questions)

1. Is it possible to get a personal loan with no credit history?

Yes, some lenders offer personal loans to individuals with no credit history, but the terms may be different from loans granted to individuals with established credit histories.

2. What is the average interest rate for personal loans?

The average interest rate for personal loans can vary based on market conditions, your credit score, and the lender. Generally, interest rates range from 6% to 36%.

3. Can I use a personal loan to start a small business?

Yes, you can use a personal loan to fund a small business, but it’s essential to consider the risks involved, as personal loans are not designed specifically for business purposes.

4. How long does it take to repay a personal loan on average?

The average repayment period for personal loans is around three to five years, but it ultimately depends on the loan amount and terms.

5. Can I get a personal loan if I already have existing loans?

Having existing loans may affect your eligibility for a new personal loan, as lenders consider your overall debt-to-income ratio while evaluating your application.

6. Can I use a personal loan for investing in the stock market?

While it’s technically possible to use a personal loan for investing, it’s generally not advisable due to the risks involved. Using borrowed money to invest in the stock market can amplify losses and lead to financial instability.

7. Can I get a personal loan with a co-signer?

Yes, having a co-signer with a strong credit history can increase your chances of getting approved for a personal loan, especially if you have a limited credit history or bad credit.

8. Are there any tax benefits associated with personal loans?

Unlike certain loans like home mortgages, personal loans typically do not offer tax benefits. The interest paid on personal loans is generally not tax-deductible.

9. What is the impact of a personal loan on my debt-to-income ratio?

Taking on a personal loan increases your debt load, which can affect your debt-to-income ratio. It’s essential to maintain a healthy balance between your debt and income to qualify for better loan terms in the future.

10. Can I apply for multiple personal loans simultaneously?

While you can apply for multiple personal loans, doing so may negatively impact your credit score and create a perception of financial instability among lenders.

11. How can I improve my chances of getting approved for a personal loan?

Improving your credit score, maintaining a stable income, and reducing existing debts can significantly enhance your chances of getting approved for a personal loan.

12. Is it possible to negotiate the terms of a personal loan?

Yes, in some cases, you may be able to negotiate the terms of a personal loan, such as interest rates and repayment periods. However, not all lenders may be open to negotiation.

13. What happens if I default on a personal loan?

Defaulting on a personal loan can have severe consequences, including damage to your credit score, legal actions, and potential asset seizure by the lender.

14. Can I transfer my personal loan to another lender for better terms?

In some cases, loan refinancing or transferring your personal loan to another lender with better terms may be possible. However, it’s essential to consider the associated costs and benefits.

15. Can I use a personal loan for educational expenses?

Yes, personal loans can be used to cover educational expenses, such as tuition fees, textbooks, or educational equipment. However, it’s essential to compare interest rates with student loan options.

16. What documents do I need to apply for a personal loan?

The documents required for a personal loan application typically include proof of identity, income statements, bank statements, and address verification.

17. Can I change the repayment schedule of my personal loan?

In certain cases, you may be able to modify the repayment schedule of your personal loan through loan restructuring or discussing options with the lender.

18. Is a personal loan better than using a credit card for large purchases?

The choice between a personal loan and a credit card for large purchases depends on your financial situation and the interest rates offered. Personal loans may offer lower interest rates for significant expenses.

19. Can I get a personal loan if I’m self-employed?

Yes, self-employed individuals can apply for personal loans. However, they may need to provide additional documentation, such as business financial statements, to prove their income stability.

20. What is the difference between a secured and unsecured personal loan?

A secured personal loan requires collateral, such as a car or property, to secure the loan, while an unsecured personal loan does not require any collateral.

21. Can I use a personal loan to consolidate my debts?

Yes, debt consolidation is a common reason for taking a personal loan. It allows you to combine multiple debts into one, making it easier to manage and potentially reducing the overall interest cost.

22. Is there an age limit to apply for a personal loan?

Most lenders have a minimum age requirement, typically 18 years old, to apply for a personal loan. Some lenders may also have a maximum age limit

23. Can I get a personal loan if I have a low income?

While having a higher income increases your chances of loan approval, some lenders offer personal loans to individuals with lower incomes, considering other factors like creditworthiness.

24. Are personal loans available for non-residents or foreigners?

Personal loans may be available to non-residents or foreigners, but eligibility criteria may vary, and additional documentation might be required.

25. Can I use a personal loan to fund my wedding expenses?

Yes, personal loans can be used to cover wedding expenses. It’s essential to plan your budget carefully to avoid overborrowing and potential financial strain.